5 Benefits Of Life Insurance Maturity Benefits Of Most Insurance Policies Are Tax Free Under Section 10 (10d) And The Premium Paid Is Eligible For Deduction Under Section 80c Of The Income Tax Act, 1961.

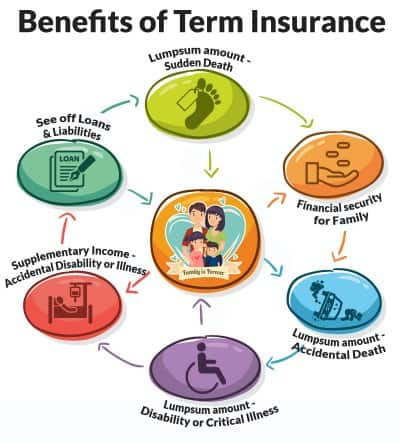

5 Benefits Of Life Insurance. Term Life Insurance Is A Kind Of Life Insurance Plan That Provides Death Coverage To Policyholders For A Specific Time Limit.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance cover4 for financial security of your family.

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

How can life insurance help?

Some life insurance policies have optional features, called riders, sometimes available at an additional cost, that let you.

Benefits of life insurance for individuals.

Many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

The endowment life insurance plan has all benefits of a term insurance plan.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

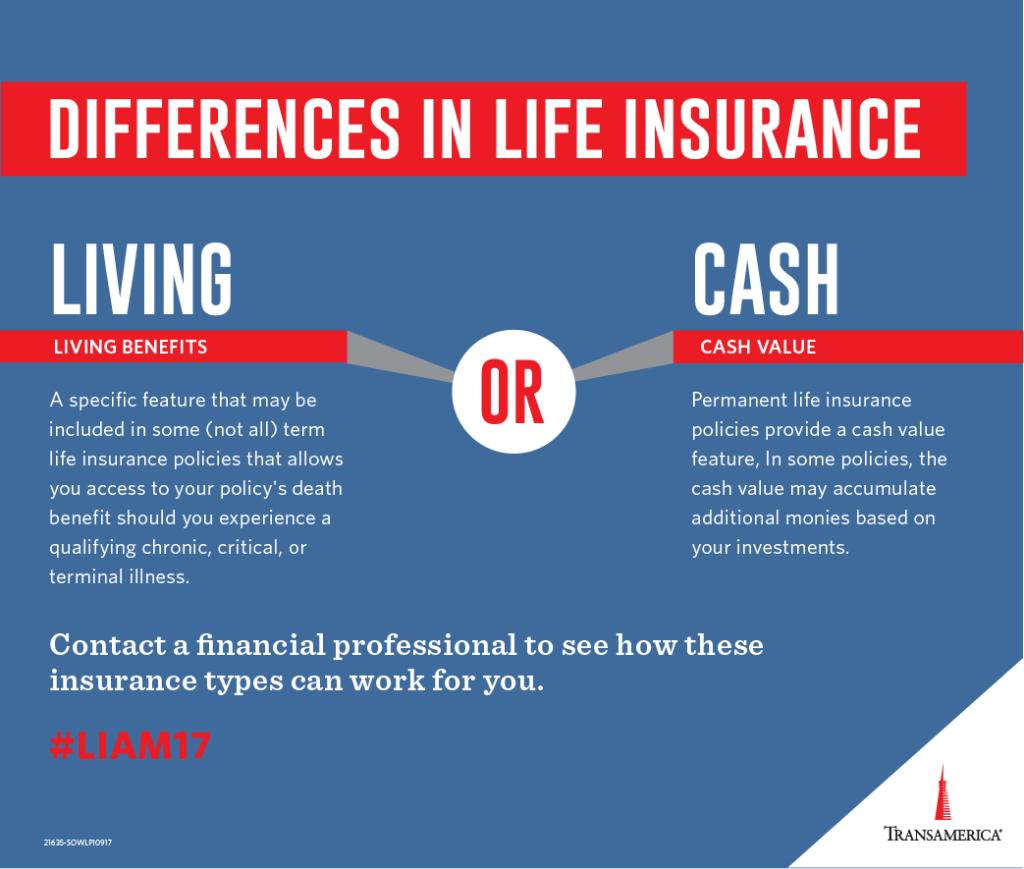

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

This means that if the policyholder is.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

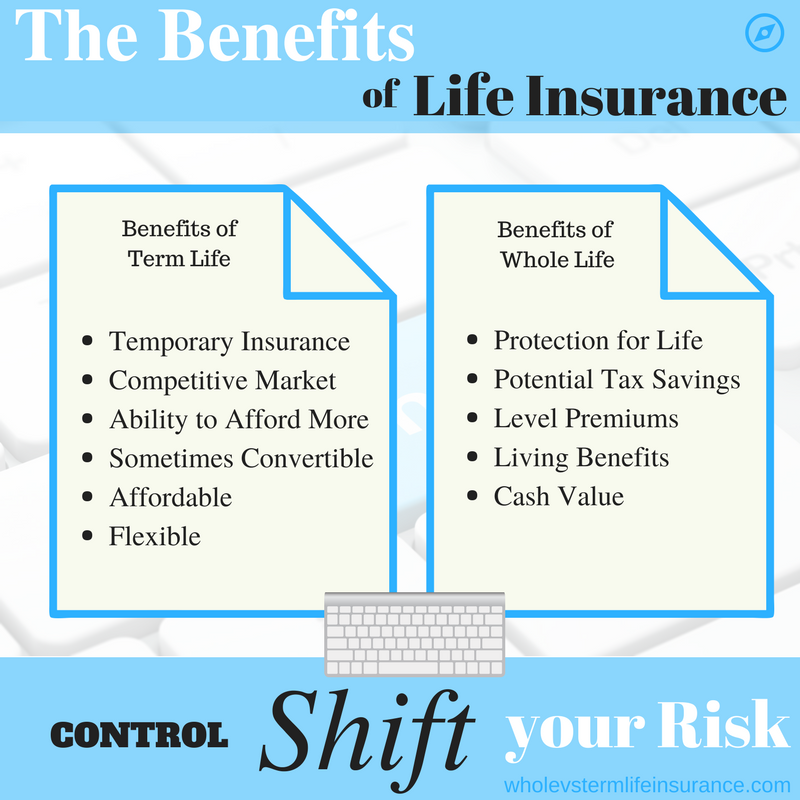

Term life insurance is a kind of life insurance plan that provides death coverage to policyholders for a specific time limit.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Buying it as a gift for a child can be an affordable way to meet many.

To get tax deduction under section 80c, the premium of a life insurance.

Beyond the familiar death benefit, permanent life insurance has several valuable advantages that can both expand and protect your financial security.

Once it accumulates, your life insurance cash value is accessible through policy loan or withdrawal for family and business opportunities, education.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

Group life insurance coverage is usually based on your salary, and depending on how much financial support your family needs, you may need more coverage almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit.

Life insurance gives you and your family financial security.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

Benefits administrators and others chosen by your employer to assist you with your participation in the employee benefit programs administered by the south carolina public employee benefit authority (peba) are not agents or employees of peba and.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

There are multiple types of life insurance, each with its own costs and benefits, the two most common being term life insurance and whole life insurance.

Tips Jitu Deteksi Madu Palsu (Bagian 2)Cegah Celaka, Waspada Bahaya Sindrom HipersomniaObat Hebat, Si Sisik NagaTernyata Menikmati Alam Bebas Ada Manfaatnya5 Manfaat Meredam Kaki Di Air EsUban, Lawan Dengan Kulit KentangTernyata Tertawa Itu DukaSalah Pilih Sabun, Ini Risikonya!!!Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatTernyata Einstein Sering Lupa Kunci MotorLike any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life. 5 Benefits Of Life Insurance. There are multiple types of life insurance, each with its own costs and benefits, the two most common being term life insurance and whole life insurance.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance cover4 for financial security of your family.

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

How can life insurance help?

Some life insurance policies have optional features, called riders, sometimes available at an additional cost, that let you.

Benefits of life insurance for individuals.

Many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

The endowment life insurance plan has all benefits of a term insurance plan.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

This means that if the policyholder is.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

Term life insurance is a kind of life insurance plan that provides death coverage to policyholders for a specific time limit.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Buying it as a gift for a child can be an affordable way to meet many.

To get tax deduction under section 80c, the premium of a life insurance.

Beyond the familiar death benefit, permanent life insurance has several valuable advantages that can both expand and protect your financial security.

Once it accumulates, your life insurance cash value is accessible through policy loan or withdrawal for family and business opportunities, education.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

Group life insurance coverage is usually based on your salary, and depending on how much financial support your family needs, you may need more coverage almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit.

Life insurance gives you and your family financial security.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

Benefits administrators and others chosen by your employer to assist you with your participation in the employee benefit programs administered by the south carolina public employee benefit authority (peba) are not agents or employees of peba and.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

There are multiple types of life insurance, each with its own costs and benefits, the two most common being term life insurance and whole life insurance.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life. 5 Benefits Of Life Insurance. There are multiple types of life insurance, each with its own costs and benefits, the two most common being term life insurance and whole life insurance.Cegah Alot, Ini Cara Benar Olah Cumi-CumiTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Ayam Suwir Pedas Ala CeritaKulinerIkan Tongkol Bikin Gatal? Ini Penjelasannya5 Trik Matangkan ManggaResep Cumi Goreng Tepung MantulResep Beef Teriyaki Ala CeritaKulinerTips Memilih Beras BerkualitasResep Segar Nikmat Bihun Tom YamResep Yakitori, Sate Ayam Ala Jepang

Comments

Post a Comment