5 Benefits Of Life Insurance Payouts Are Generally Tax Free, So Your Beneficiaries Won't Need To Cough Up Extra Money.

5 Benefits Of Life Insurance. 16 A Day To Protect Your Family.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Compare and buy 1 cr life cover at rs.

16 a day to protect your family.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

Life insurance cover4 for financial security of your family.

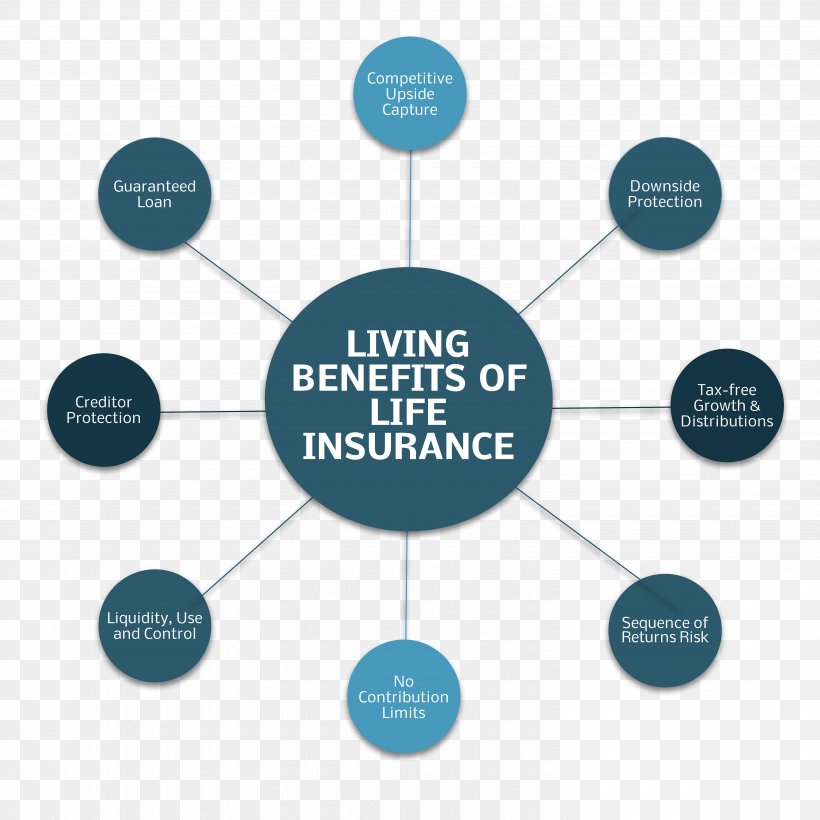

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

How can life insurance help?

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

With so many life insurance options, you can likely find a policy that fits your life insurance goals.

The life insurance industry is slowly evolving trying to adjust to match the needs of today's consumer.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

Did you know that you can sell your life insurance policy?

If you didn't, you're not alone.

Most americans don't realize that they can sell their life insurance just like any other personal property.

Term life insurance is a kind of life insurance plan that provides death coverage to policyholders for a specific time limit.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Fortunately, there is a solution!

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

This means that if the policyholder is.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

Life insurance is significantly cheaper when you're young, and if you buy a term life insurance policy, you can roll it over into permanent coverage when you're almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're.

To get tax deduction under section 80c, the premium of a life insurance.

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

This type of insurance relieves the insured person's relatives of the.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Buying it as a gift for a child can be an affordable way to meet many.

Term life insurance is a type of life insurance that will pay out a specific sum if you die during the time you are insured.

It's a key benefit to help you attract and keep quality employees.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

Information on the benefits of term life insurance & how it works.

Since term life insurance costs are so affordable, you can purchase the amount of life insurance coverage required to help meet all of your specific goals.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

Are you aware of the benefits of health insurance?

Cover for life threatening critical illnesses.

Do you believe that you will never need health insurance because you are fit and fine? 5 Benefits Of Life Insurance. Cover for life threatening critical illnesses.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Compare and buy 1 cr life cover at rs.

16 a day to protect your family.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

Life insurance cover4 for financial security of your family.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

How can life insurance help?

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

With so many life insurance options, you can likely find a policy that fits your life insurance goals.

The life insurance industry is slowly evolving trying to adjust to match the needs of today's consumer.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

Did you know that you can sell your life insurance policy?

If you didn't, you're not alone.

Most americans don't realize that they can sell their life insurance just like any other personal property.

Term life insurance is a kind of life insurance plan that provides death coverage to policyholders for a specific time limit.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Fortunately, there is a solution!

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

This means that if the policyholder is.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

Life insurance is significantly cheaper when you're young, and if you buy a term life insurance policy, you can roll it over into permanent coverage when you're almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're.

To get tax deduction under section 80c, the premium of a life insurance.

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

This type of insurance relieves the insured person's relatives of the.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Buying it as a gift for a child can be an affordable way to meet many.

Term life insurance is a type of life insurance that will pay out a specific sum if you die during the time you are insured.

It's a key benefit to help you attract and keep quality employees.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

Information on the benefits of term life insurance & how it works.

Since term life insurance costs are so affordable, you can purchase the amount of life insurance coverage required to help meet all of your specific goals.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

Are you aware of the benefits of health insurance?

Cover for life threatening critical illnesses.

Do you believe that you will never need health insurance because you are fit and fine? 5 Benefits Of Life Insurance. Cover for life threatening critical illnesses.

Comments

Post a Comment