5 Pros Of Life Insurance The Money Invested Will Fetch Good Returns And Will Be Returned Fully As Sum Assured Either After The Completion Of The Term Or After The Demise Of The Insured.

5 Pros Of Life Insurance. But Generally, The More Life Insurance You Have, The More Benefits It Will Provide To Your Family When Needed.

SELAMAT MEMBACA!

If you have a life insurance policy and die while your coverage is in effect, your beneficiaries will receive a lump sum death benefit.

In actuality, life insurance is inexpensive and much more accessible that you think.

When you break it down life that, it's easier to budget for and less scary to think about.

Life insurance is a safety net for anyone who has dependents.

When the breadwinner of a household dies, that family is often left with crippling financial burdens that they may not be able to recover from.

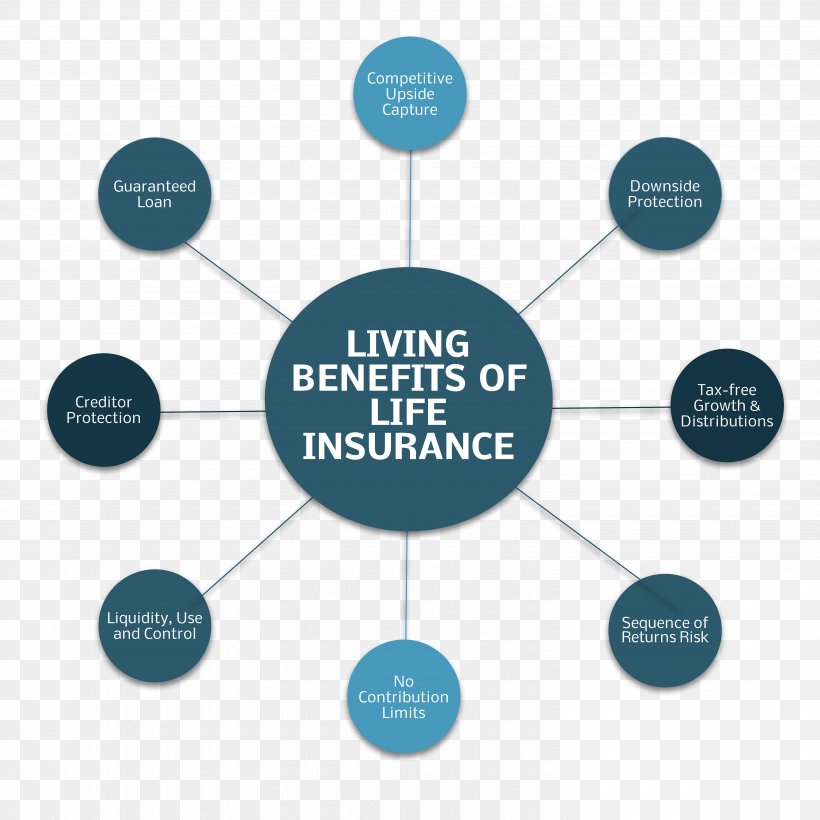

The cash value of your whole life insurance policy is a hard asset, meaning it can be used as collateral and can be borrowed against.

This is a useful feature for a family that, for instance, has a.

If you'd like to have a specific person receive your benefits as an inheritance, the insurance information institute (iii) suggests naming your chosen heir as the beneficiary on your policy.

This will ensure that your life insurance benefits fall into the hands of the.

Life insurance benefits can fully or partially help your beneficiaries to pay off these taxes, allowing them to have fewer financial worries in their difficult time.

Benefits of life insurance for individuals #1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their monthly bills.

This may include payment of the decedent's final expenses and mortgage on the family home for the policyholder's survivors.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Whole life plan coverage lasts for your entire life and doesn't change as long as your premiums are paid.

Premiums typically stay the same for the life of the policy.

Whole life builds cash value that can be borrowed against while living.

Of course, the benefits and costs of a life insurance policy vary depending on which type of policy you buy.

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

Learn about the pros and cons of a whole life policy.

Term life insurance and whole life insurance offer this benefit, although term insurance places a limit on how long the coverage will remain in force.

Most of the life insurance schemes offer bonuses that no other investment scheme can offer.

The money invested in life insurance is safe and covers risks.

Pros of buying life insurance for a child.

The biggest selling point of a life insurance policy for a child is that you're guaranteeing that your child will have.

Since permanent life insurance is known to be more expensive, policygenius has a team of licensed agents (who don't work on commission) to help guide you and give advice on getting the right policy for your needs.

Guaranteed (but modest) return on money;

Term life insurance is usually the most affordable type of insurance, with rates less than a dollar per day.

Your premium payments, the amount you pay the insurance company each month, will never go up.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Below we list the two common types of life insurance for estate planning:

Term life insurance is designed so that the life of the primary insured is protected for a set period of time.

Term life insurance offers 10 year terms up to 30 year terms.

Benefits of term life insurance.

Here are 5 ways an accelerated death benefit can pay for chronic illness care.

Permanent life insurance policies, such as whole and universal life insurance, offer lifelong coverage and typically have a cash value component.

A permanent policy's cash value grows over time and can be used to pay premiums or take out a loan from the insurer.

We've outlined 5 key points so you can see how do you benefit from whole life insurance.

Top 5 craziest life insurance frauds april 21, 2021 | insurance humour since the existence of life insurance there have been many people who have faked their own death and attempted to collect on a life insurance claim by splitting the claim proceeds with a beneficiary such as a spouse or relative.

Here are five compelling reasons for you to gift a life insurance plan to your spouse, whether she's a homemaker or a working professional.

In the event of an owner's death, the remaining owners can use the death benefits to buy out the deceased owner's share.

Term insurance plans are very simple to understand:

Simplicity is one of the reasons for the growing popularity of term insurance.

A standard universal life insurance policy's cash value grows according to the performance of the insurer's portfolio and can be used to pay premiums.

Pros and cons of group life insurance through work basic life insurance through work is typically free, but coverage amounts tend to be lower than individual policies.

Ini Efek Buruk Overdosis Minum KopiTernyata Tahan Kentut Bikin Keracunan5 Khasiat Buah Tin, Sudah Teruji Klinis!!Manfaat Kunyah Makanan 33 Kali5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuCara Baca Tanggal Kadaluarsa Produk Makanan5 Manfaat Meredam Kaki Di Air EsObat Hebat, Si Sisik NagaSaatnya Bersih-Bersih Usus3 X Seminggu Makan Ikan, Penyakit Kronis MinggatPros and cons of group life insurance through work basic life insurance through work is typically free, but coverage amounts tend to be lower than individual policies. 5 Pros Of Life Insurance. Georgia rose mar 11, 2021

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

16 a day to protect your family.

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance cover4 for financial security of your family.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

How can life insurance help?

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

With so many life insurance options, you can likely find a policy that fits your life insurance goals.

The life insurance industry is slowly evolving trying to adjust to match the needs of today's consumer.

Did you know that you can sell your life insurance policy?

If you didn't, you're not alone.

Your life insurance policy might be worth as much as your home!

Term life insurance is a kind of life insurance plan that provides death coverage to policyholders for a specific time limit.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Fortunately, there is a solution!

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

This means that if the policyholder is.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

Life insurance is significantly cheaper when you're young, and if you buy a term life insurance policy, you can roll it over into permanent coverage when you're almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're.

To get tax deduction under section 80c, the premium of a life insurance.

What is an executive bonus plan, also known as an irs section 162 plan?

A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance.

However, there's one thing that differentiates the two.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Buying it as a gift for a child can be an affordable way to meet many.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

Term life insurance is a type of life insurance that will pay out a specific sum if you die during the time you are insured.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

Information on the benefits of term life insurance & how it works.

Things to consider those purchasing a term life insurance policy.

Since term life insurance costs are so affordable, you can purchase the amount of life insurance coverage required to help meet all of your specific goals. 5 Pros Of Life Insurance. Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Cumi Goreng Tepung MantulBir Pletok, Bir Halal Betawi7 Makanan Pembangkit LibidoBakwan Jamur Tiram Gurih Dan NikmatNikmat Kulit Ayam, Bikin SengsaraNanas, Hoax Vs FaktaResep Stawberry Cheese Thumbprint Cookies3 Jenis Daging Bahan Bakso TerbaikSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat

Comments

Post a Comment