5 Pros Of Life Insurance Mortgage Protection Insurance (mpi) Is Similar To Life Insurance, With One Major Difference:

5 Pros Of Life Insurance. Learn How Indexed Universal Life's Growth Works.

SELAMAT MEMBACA!

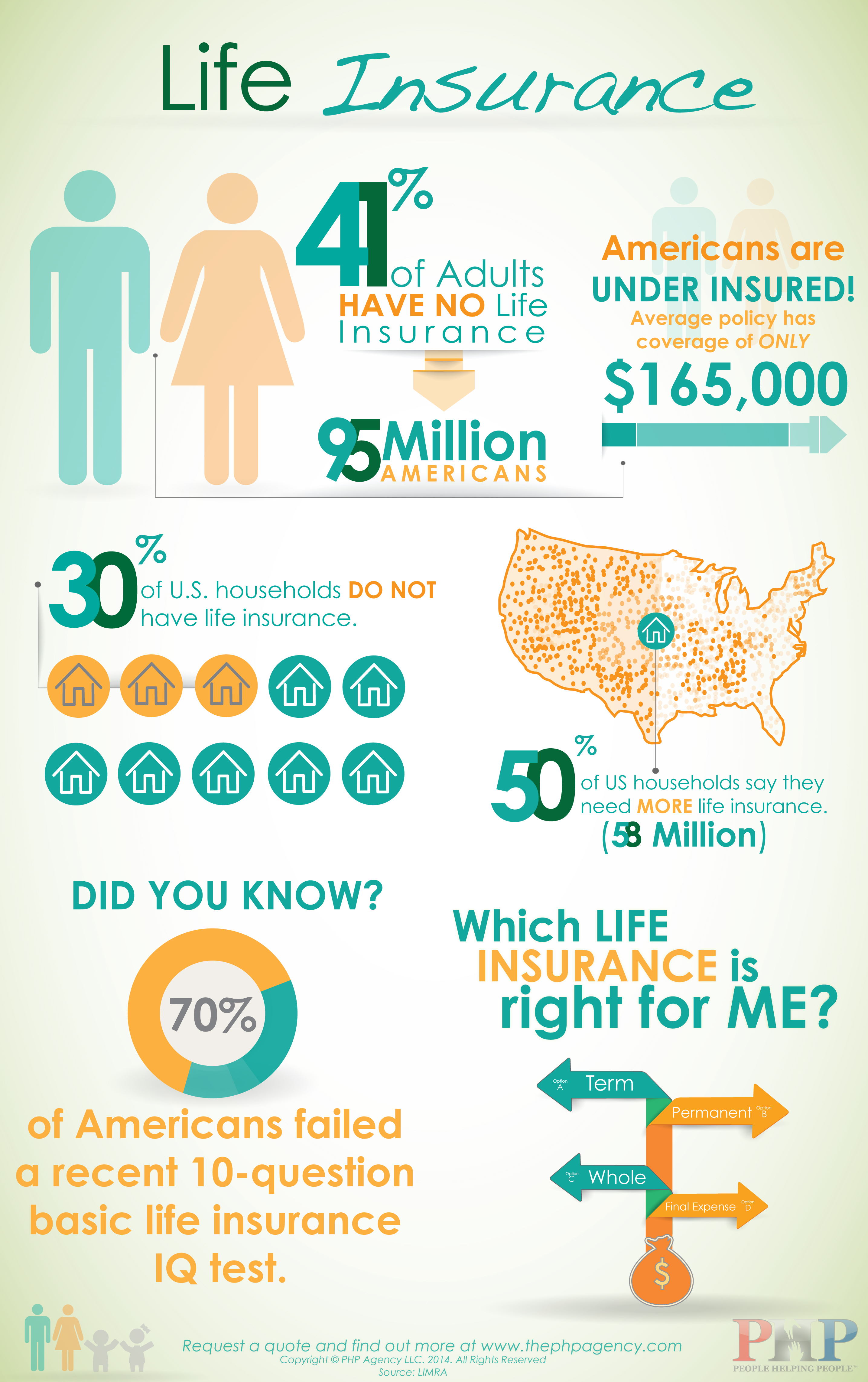

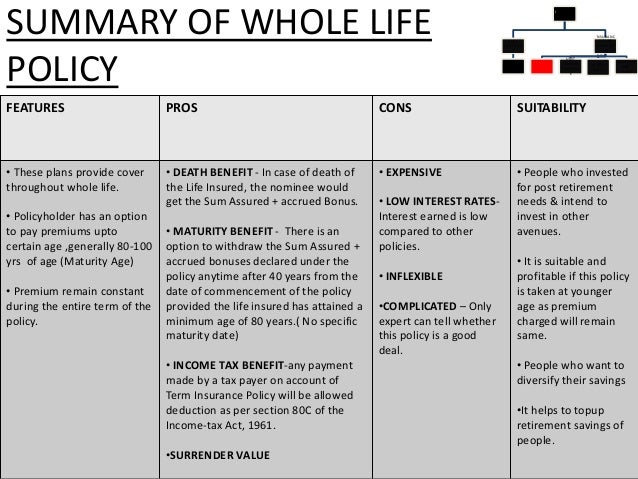

Term life insurance and whole life insurance are the two most common types of life insurance.

Term life insurance offers policyholders a benefit only plan.

Typically, term policies remain in effect from five to 30 years, depending on the term you.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

The younger and healthier you are it's important to compare various types of life insurance to find the policy that's right for you and your financial situation.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul's powerful annual reset life insurance agents who strongly favor whole life (vs.

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

The pros of life insurance include:

But would you want to leave your family and loved ones with your financial burdens?.

Endowment life insurance is a way to save for your childs college education.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

How life insurance needs can change over time.

This is an important question and life insurance shoppers need to understand the pros and cons of term life insurance.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the.

Everyone deserves a secure financial future — and that's why life insurance is so important.

Whether you're just starting out or you're getting ready to retire, a life.

Pros & cons of life insurance.

There's a lot of confusing terminology, and different types of permanent policies can be complicated.

Pat is insured with a life insurance policy and karen is his primary beneficiary.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Types of life insurance are generally broken up into four categories:

Term life, whole life, universal life and variable universal life policies.

Understanding the difference between different kinds of life insurance and their pros and cons given your circumstances will enable you to reach the goals for.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

Want to save money on your life insurance premiums?

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

Universal life insurance offers lifelong protection with a range of investment options.

Your beneficiaries will still get a death benefit after you die.

Look at sample life insurance rates for term life, universal life, and whole life.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Clear your basics of life insurance that helps you understand & choose most life insurance plans provide considerable returns during maturity, thus making it an attractive this way one can easily weigh the pros and cons and finally can choose the right insurance plan that.

There are also universal life insurance plans that differ from the 2.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Having life insurance is a necessary part of your overall financial plan.

5star life insurance company is committed to providing the highest level of service.

We can be reached on our toll free customer service number:

You must be a lawful resident of the us that has lived here for at least pros of ladder life insurance.

Who is permanent life best for?

Pros and cons of permanent.

Other types of life insurance policies.

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

Ternyata Merokok + Kopi Menyebabkan KematianAwas, Bibit Kanker Ada Di Mobil!!5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuTernyata Madu Atasi InsomniaVitalitas Pria, Cukup Bawang Putih SajaTernyata Ini Beda Basil Dan Kemangi!!PD Hancur Gegara Bau Badan, Ini Solusinya!!5 Manfaat Meredam Kaki Di Air EsTernyata Tidur Bisa Buat MeninggalIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatIn traditional insurance plans, the premium amount remains flat from start to conclusion. 5 Pros Of Life Insurance. Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

There are several advantages and disadvantages of life insurance.

Read on to know the benefits and drawbacks.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

The advantages and disadvantages to purchasing term life insurance can be significant, so this article will help you understand them.

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

Create your own private bank using whole life insurance and gain 5 important advantages discussed in this video.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

That's because a life insurance policy can help you ensure that your loved ones have a not only can life insurance help cover your final expenses — it can also provide your family with a financial safety net by helping to replace your.

Life insurance companies realize that every person wants to feel safe.

To protect yourself and your family, there are many types of insurance packages that certainly offers safety when an unexpected there are many advantages and disadvantages of life insurance policies that are described below.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

As long as you pay your premiums, your permanent policy will pay a death benefit.

/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg)

You have many options concerning the type of policy you take out including term and permanent life insurance policies.

Life insurance has many advantages, which should weigh in on your decision.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Advantages of life insurance 2.

Life insurance provides you the advantage of taking a policy loan in case you are in desperate need of money.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be now that you know the advantages and disadvantages of both categories of insurance, you can start to comparison shop.

The best way to find affordable.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Compare term life providers learn more.

Term life insurance is temporary with policies lasting between one and 35 years.

It's the cheapest coverage available and it.

However, there are also disadvantages life insurance is a process of putting in place a sort of shock absorber for your dependents in case of your sudden death.

In the process, you also get.

Whole life policies are not for everyone, but they do offer certain benefits over other types of life insurance for many individuals.

Medical insurance is one of the most popular insurance services.

About 1,000,000 people, including employees of various companies and organizations in various parts around the the delay in benefits and consultations should make us reflect on the advantages that private insurance would bring.

Other than these advantages a life insurance policy also helps a person in paying taxes.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages.

Life positioning of life insurance can be complex particularly if the insurance is for complex family situations, business situations and estate planning.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

So, it's not necessarily the type of plan that you buy but the risk you pose to the insurance carrier that.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Term life insurance has innumerable advantages for those who choose them, however, it is necessary to know their modalities well.

Another comparative advantage of this type of insurance is found in the possibility of the holder, of converting his term insurance for a permanent one, not choosing to.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Tax advantages of life insurance living benefits. 5 Pros Of Life Insurance. This is where it really gets goodResep Stawberry Cheese Thumbprint CookiesResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Kreasi Potato Wedges Anti GagalIkan Tongkol Bikin Gatal? Ini PenjelasannyaPete, Obat Alternatif DiabetesSusu Penyebab Jerawat???Resep Selai Nanas Homemade3 Cara Pengawetan Cabai9 Jenis-Jenis Kurma TerfavoritTips Memilih Beras Berkualitas

Comments

Post a Comment