5 Benefits Of Life Insurance Here, We'll Discuss Life Insurance With Living Benefits In 2021.

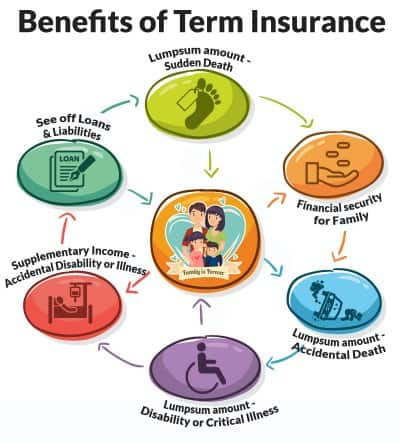

5 Benefits Of Life Insurance. Living Benefits That Can Be Added To A Term Life Insurance Policy Allow The Policyholder To Access Their Financial Relief In Times Of A Chronic Or Catastrophic Illness.

SELAMAT MEMBACA!

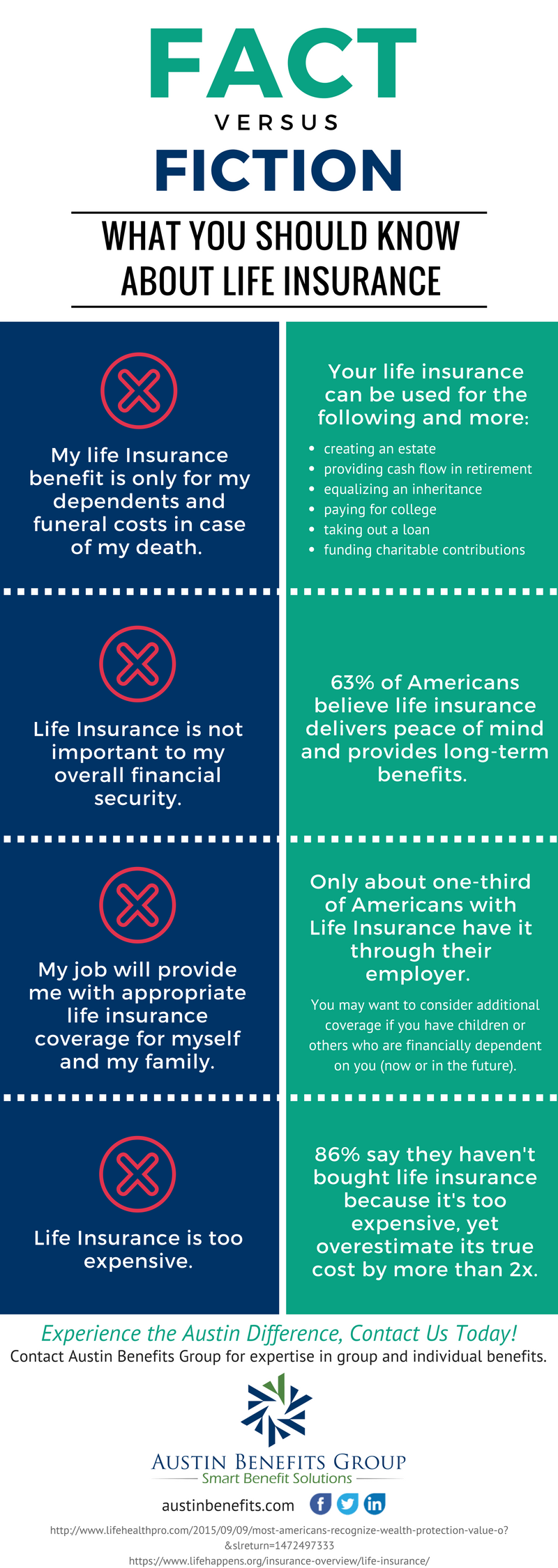

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Life insurance can be essential for protecting your family in the event of a tragedy.

It also has tax benefits and other uses.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Here are 5 ways an accelerated death benefit can pay for chronic illness care.

Benefits of universal life insurance.

How can i find affordable insurance?

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their monthly bills.

Many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

Life insurance cover4 for financial security of your family.

5 benefits of insurance | life insurance.

Term life insurance is a top choice for people who want to cover financial obligations that are common when raising a family.

And within each of those types are further varieties.

With so many life insurance options, you can.

Gerber life whole life insurance provides financial protection for you and for your family when you're no longer here.

Here are the top five benefits of whole life insurance for you to consider

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Term life insurance provides protection for a set period of time, such as 10 or 20 years.

The funds within this life.

There are certain restrictions related to the income tax benefits of life insurance policy, imposed by the ministry of finance [2].

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

Unlike term life insurance, permanent life insurance isn't just a death benefit.

It's also a sort of savings or investing vehicle.

Because of the risk, universal life insurance is typically cheaper than whole life insurance.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Buying it as a gift for a child can be an affordable way to meet many.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Life insurance can even be used to help fund a child's education.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

The endowment life insurance plan has all benefits of a term insurance plan.

As per this insurance plan, the accumulated funds through the premiums are collected as the insured's asset, the benefit of which is distributed regularly to the insured, after he takes a professional retirement.

But not as many people insure the most valuable thing of the key benefits of life insurance.

Life insurance payouts can help provide financial security for loved ones.

It can help reduce the disruption of losing a.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit.

A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance.

Life insurance gives you and your family financial security.

Mulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Madu Atasi InsomniaUban, Lawan Dengan Kulit KentangSaatnya Bersih-Bersih Usus5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuTernyata Orgasmes Adalah Obat Segala ObatTips Jitu Deteksi Madu Palsu (Bagian 2)5 Olahan Jahe Bikin SehatTernyata Tahan Kentut Bikin KeracunanManfaat Kunyah Makanan 33 KaliA variety of life insurance options are available. 5 Benefits Of Life Insurance. In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

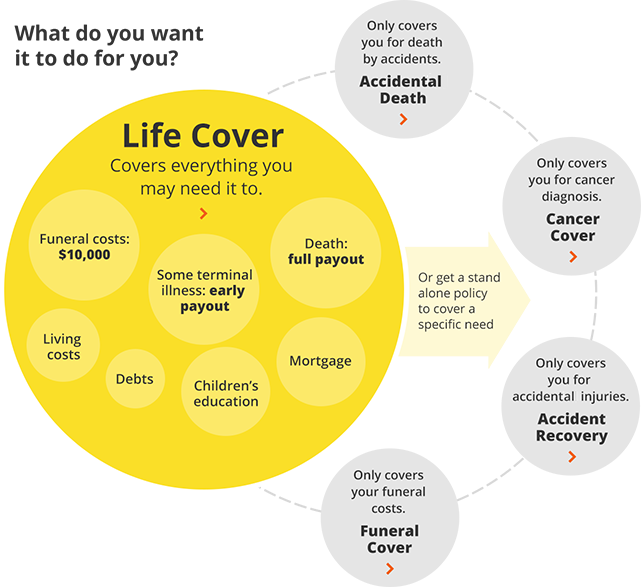

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Life insurance can be essential for protecting your family in the event of a tragedy.

It also has tax benefits and other uses.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Here are 5 ways an accelerated death benefit can pay for chronic illness care.

Benefits of universal life insurance.

How can i find affordable insurance?

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their monthly bills.

Many sole proprietors can also utilize the benefits of life insurance.

Here, the policy may be utilized as a business continuation plan.

Life insurance cover4 for financial security of your family.

5 benefits of insurance | life insurance.

Term life insurance is a top choice for people who want to cover financial obligations that are common when raising a family.

And within each of those types are further varieties.

With so many life insurance options, you can.

Gerber life whole life insurance provides financial protection for you and for your family when you're no longer here.

Here are the top five benefits of whole life insurance for you to consider

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

Living benefits riders might even benefit you.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Term life insurance provides protection for a set period of time, such as 10 or 20 years.

The funds within this life.

There are certain restrictions related to the income tax benefits of life insurance policy, imposed by the ministry of finance [2].

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

Unlike term life insurance, permanent life insurance isn't just a death benefit.

It's also a sort of savings or investing vehicle.

Because of the risk, universal life insurance is typically cheaper than whole life insurance.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Buying it as a gift for a child can be an affordable way to meet many.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Life insurance can even be used to help fund a child's education.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

The endowment life insurance plan has all benefits of a term insurance plan.

As per this insurance plan, the accumulated funds through the premiums are collected as the insured's asset, the benefit of which is distributed regularly to the insured, after he takes a professional retirement.

But not as many people insure the most valuable thing of the key benefits of life insurance.

Life insurance payouts can help provide financial security for loved ones.

It can help reduce the disruption of losing a.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit.

A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance.

Life insurance gives you and your family financial security.

A variety of life insurance options are available. 5 Benefits Of Life Insurance. In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.Ternyata Kamu Tidak Tau Makanan Ini Khas Bulan RamadhanNikmat Kulit Ayam, Bikin SengsaraTips Memilih Beras BerkualitasResep Nikmat Gurih Bakso Lele5 Makanan Pencegah Gangguan PendengaranPetis, Awalnya Adalah Upeti Untuk RajaTernyata Pecel Pertama Kali Di Makan Oleh Sunan KalijagaResep Pancake Homemade Sangat Mudah Dan EkonomisPete, Obat Alternatif DiabetesBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi Luwak

Comments

Post a Comment