5 Advantages Of Life Insurance Create Your Own Private Bank Using Whole Life Insurance And Gain 5 Important Advantages Discussed In This Video.

5 Advantages Of Life Insurance. With Various Types Of Life Insurance Plans Available, You Can Plan Your.

SELAMAT MEMBACA!

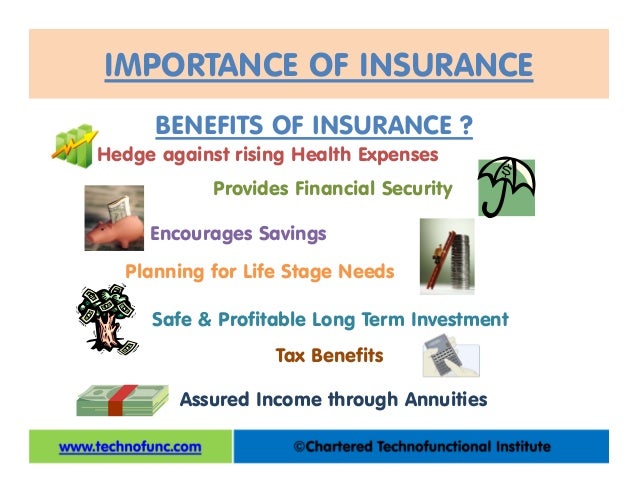

Buying and having a life insurance is one of the most important decisions that everyone should take in their life.

Do keep in mind, these disadvantages and disadvantages shouldn't come in way of your.

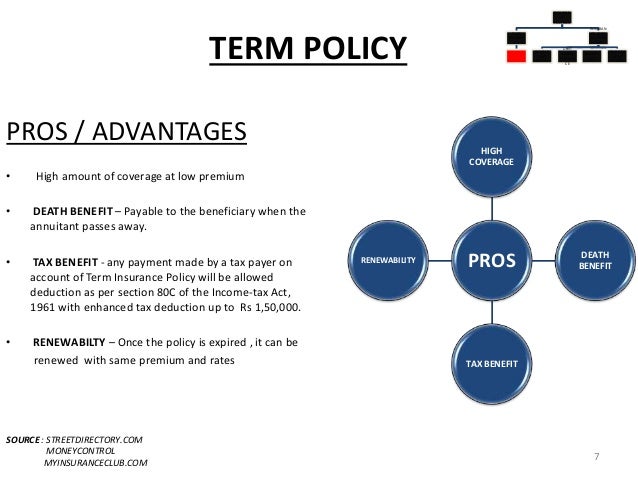

What are the advantages and disadvantages of term life insurance?

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

To protect yourself and your family, there are many types of insurance packages that certainly offers safety when an unexpected there are many advantages and disadvantages of life insurance policies that are described below.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Create your own private bank using whole life insurance and gain 5 important advantages discussed in this video.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

That's because a life insurance policy can help you ensure that your loved ones have a not only can life insurance help cover your final expenses — it can also provide your family with a financial safety net by helping to replace your.

Life insurance protects your beneficiaries in the face of your death.

You have many options concerning the type of policy you take out including term and permanent life insurance policies.

As long as you pay your premiums, your permanent policy will pay a death benefit.

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance, which can be great if you're trying to save money right now.

Advantages of life insurance 2.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

#3 — those who may.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Life insurance provides you the advantage of taking a policy loan in case you are in desperate need of money.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Some of the advantages of whole life insurance have to do with its cash value, the held liquidity, and the fact that policy owners can legitimately save for the future.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be now that you know the advantages and disadvantages of both categories of insurance, you can start to comparison shop.

Establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit works, it simply means that you set up a trust which now owns your life insurance policy and distributes the funds according to the terms of the trust.

The advantages offered by life insurance policies are not offered by any other type of financial investment.

In the process, you also get.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

Saatnya Bersih-Bersih UsusTernyata Madu Atasi InsomniaKhasiat Luar Biasa Bawang Putih PanggangTernyata Merokok + Kopi Menyebabkan KematianSehat Sekejap Dengan Es BatuMelawan Pikun Dengan ApelTernyata Ini Beda Basil Dan Kemangi!!Vitalitas Pria, Cukup Bawang Putih Saja8 Bahan Alami Detox Ini Manfaat Seledri Bagi KesehatanWhether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates. 5 Advantages Of Life Insurance. So, it's not necessarily the type of plan that you buy but the risk you pose to the insurance carrier that.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Click now to read top 5 benefits of life insurance benefits.

The section 80c of the.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

Learn about the several life insurance option to receive guaranteed income from 2nd year onwards2.

Life insurance cover4 for financial security of your family.

Benefits of life insurance for individuals.

Here, the policy may be utilized as a business continuation plan.

This way, if the sole.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Some life insurance policies have optional features, called riders, sometimes available at an additional cost, that let you.

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

What are the benefits of term life insurance?

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

This means that if the policyholder is.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

To get tax deduction under section 80c, the premium of a life insurance.

(as you get older, life insurance generally becomes more expensive.) with our whole life insurance plan, your premium rate will lock in and never increase also, keep in mind that one of the benefits of whole life insurance is that it builds cash value over time.

That's because each time you pay your.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

The endowment life insurance plan has all benefits of a term insurance plan.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

The scammer will trick you into believing that you are eligible for benefits of another person's policy and that the said person passed away, leaving you eligible to claim insurance.

7 benefits of life insurance for the wealthy.

By chris huntley on march 24, 2021.

For those unfamiliar with how an ilit.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

Life insurance is significantly cheaper when you're young, and if you buy a term life insurance policy, you can roll it over into permanent coverage when you're almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

It's also a sort of savings or investing vehicle.

Because of the risk, universal life insurance is typically cheaper than whole life insurance.

One potential benefit of universal life is that the premium is somewhat flexible.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider. 5 Advantages Of Life Insurance. The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.Buat Sendiri Minuman Detoxmu!!Ternyata Kue Apem Bukan Kue Asli Indonesia5 Trik Matangkan ManggaTernyata Jajanan Pasar Ini Punya Arti RomantisSejarah Gudeg JogyakartaPete, Obat Alternatif DiabetesSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat Ramadhan7 Makanan Pembangkit LibidoSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatBir Pletok, Bir Halal Betawi

Comments

Post a Comment