5 Advantages Of Life Insurance Term Life Insurance Offers Four Important Advantages.

5 Advantages Of Life Insurance. So, It's Not Necessarily The Type Of Plan That You Buy But The Risk You Pose To The Insurance Carrier That.

SELAMAT MEMBACA!

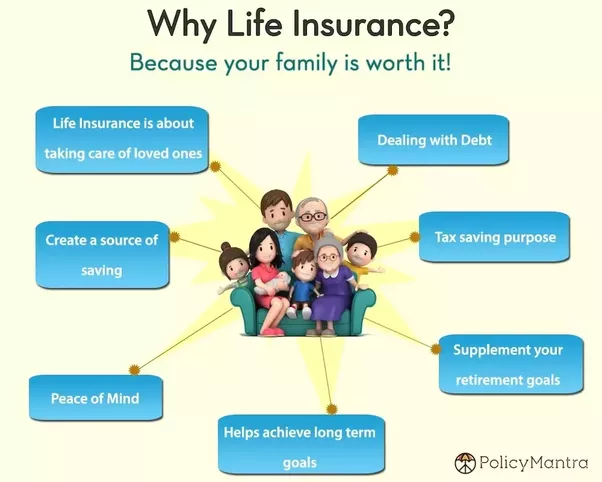

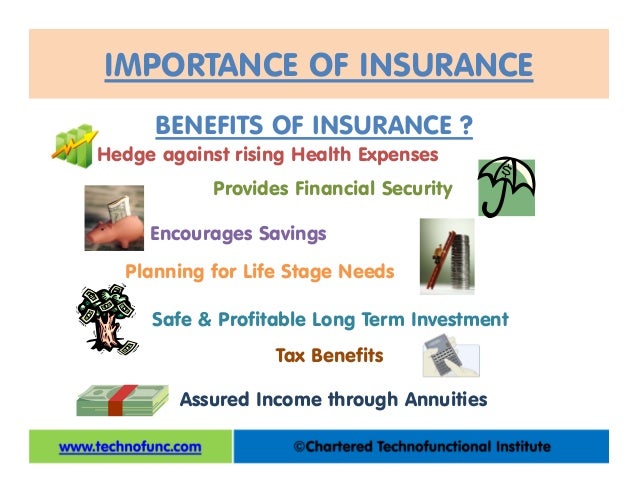

Buying and having a life insurance is one of the most important decisions that everyone should take in their life.

Do keep in mind, these disadvantages and disadvantages shouldn't come in way of your.

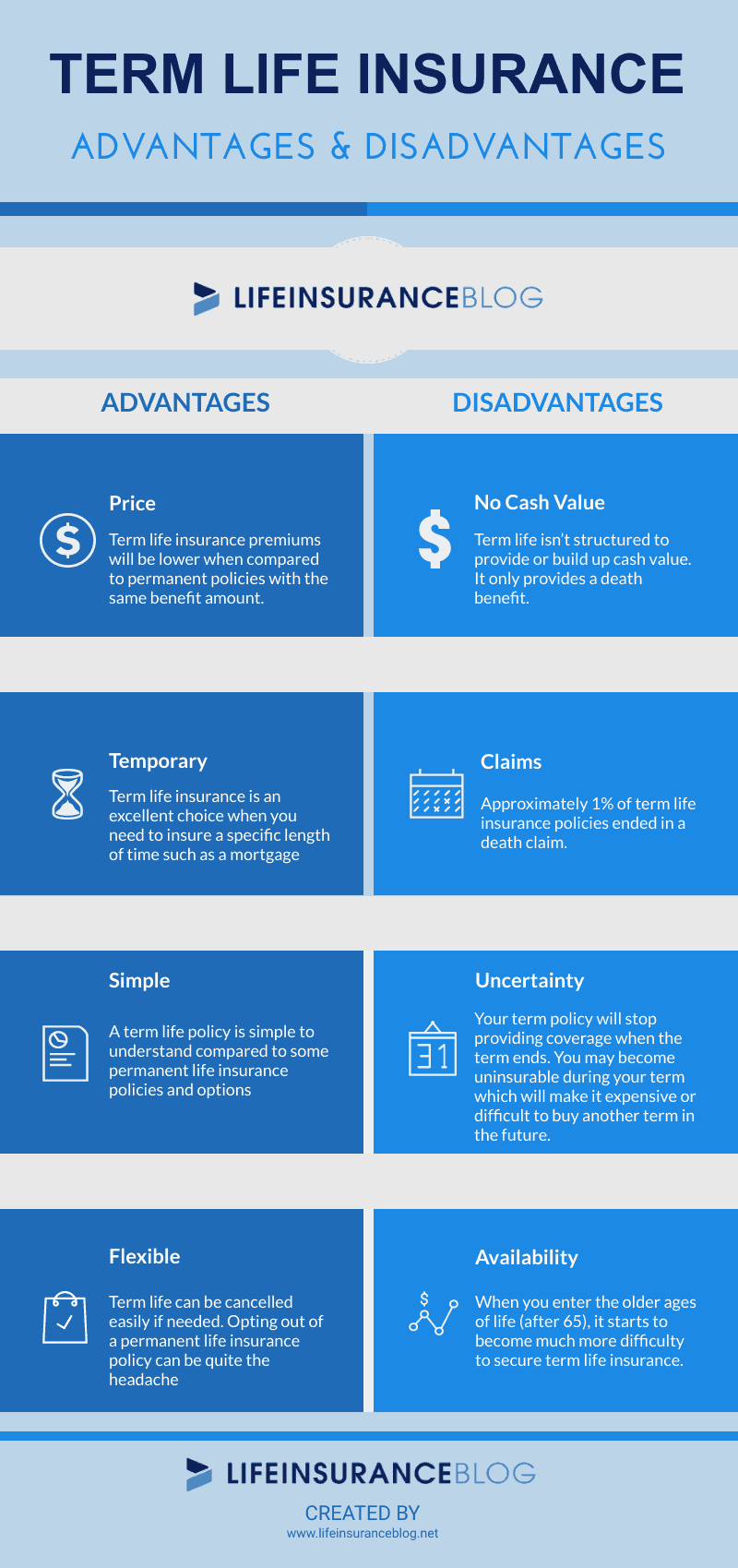

What are the advantages and disadvantages of term life insurance?

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

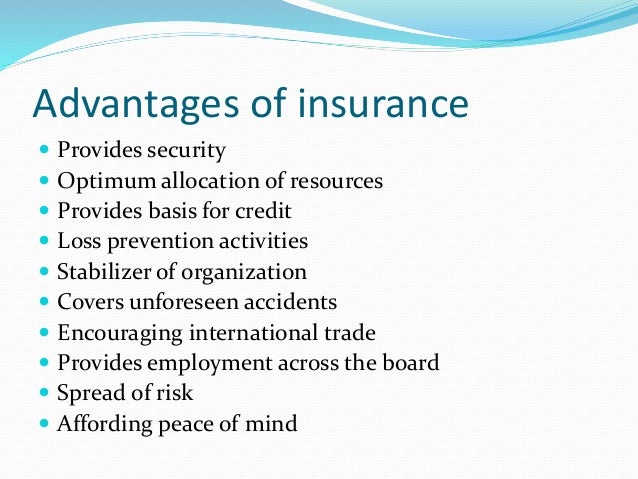

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

To protect yourself and your family, there are many types of insurance packages that certainly offers safety when an unexpected there are many advantages and disadvantages of life insurance policies that are described below.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Create your own private bank using whole life insurance and gain 5 important advantages discussed in this video.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

That's because a life insurance policy can help you ensure that your loved ones have a not only can life insurance help cover your final expenses — it can also provide your family with a financial safety net by helping to replace your.

Life insurance protects your beneficiaries in the face of your death.

You have many options concerning the type of policy you take out including term and permanent life insurance policies.

As long as you pay your premiums, your permanent policy will pay a death benefit.

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

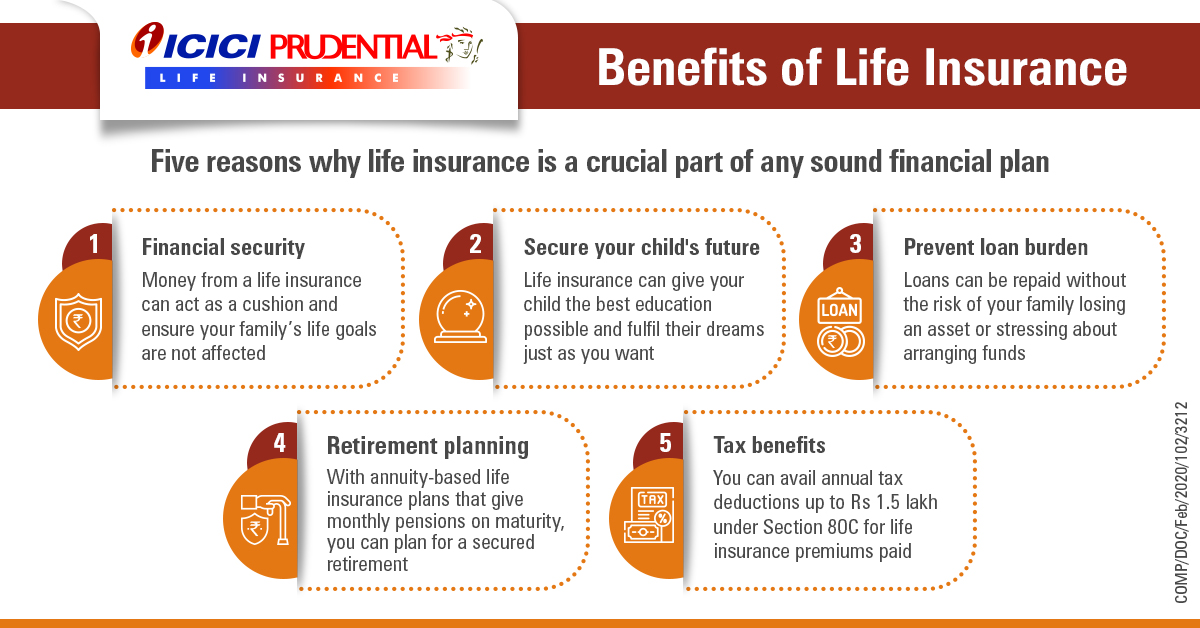

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

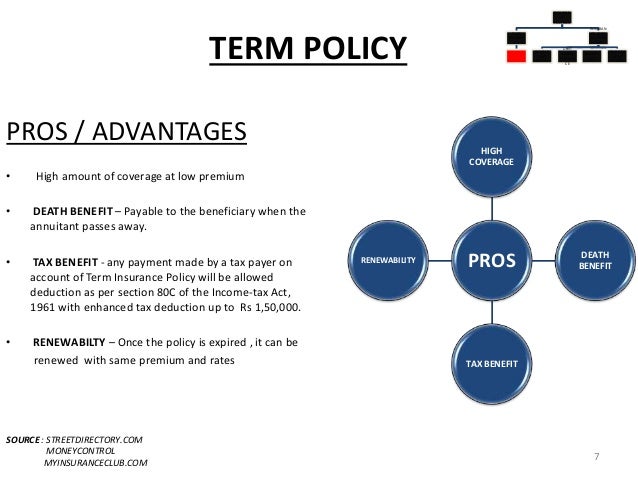

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance, which can be great if you're trying to save money right now.

Advantages of life insurance 2.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

#3 — those who may.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Life insurance provides you the advantage of taking a policy loan in case you are in desperate need of money.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

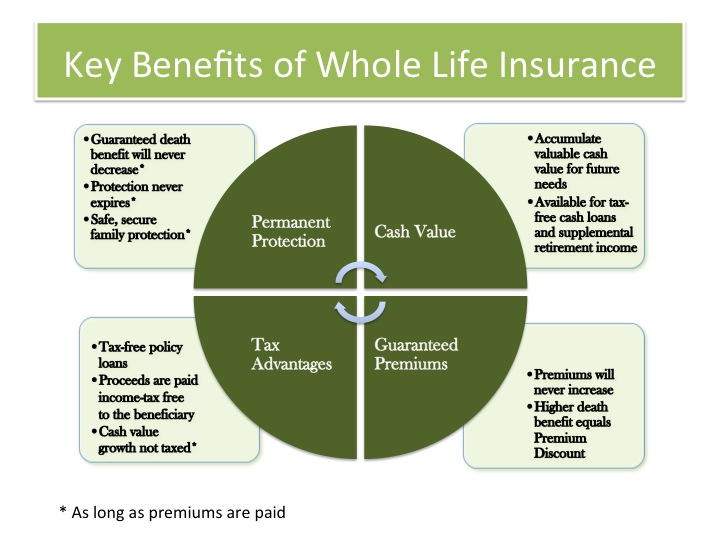

Some of the advantages of whole life insurance have to do with its cash value, the held liquidity, and the fact that policy owners can legitimately save for the future.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be now that you know the advantages and disadvantages of both categories of insurance, you can start to comparison shop.

Establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit works, it simply means that you set up a trust which now owns your life insurance policy and distributes the funds according to the terms of the trust.

The advantages offered by life insurance policies are not offered by any other type of financial investment.

In the process, you also get.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

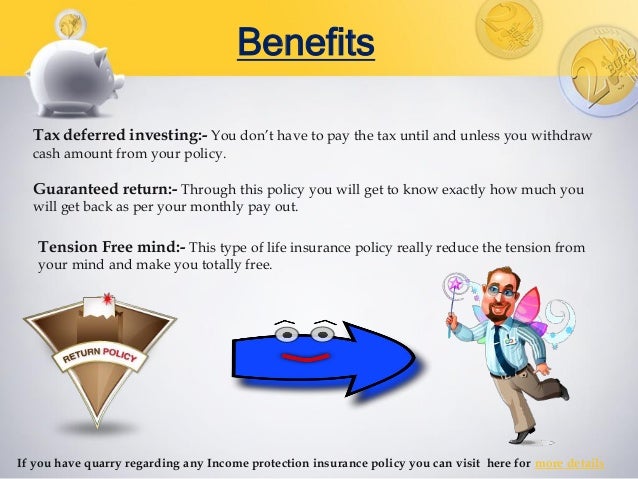

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

Sehat Sekejap Dengan Es BatuTips Jitu Deteksi Madu Palsu (Bagian 1)6 Khasiat Cengkih, Yang Terakhir Bikin HebohPentingnya Makan Setelah OlahragaHindari Makanan Dan Minuman Ini Kala Perut KosongTernyata Tertawa Itu Duka4 Titik Akupresur Agar Tidurmu NyenyakMengusir Komedo Membandel - Bagian 2Cara Benar Memasak SayuranMulti Guna Air Kelapa HijauWhether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates. 5 Advantages Of Life Insurance. So, it's not necessarily the type of plan that you buy but the risk you pose to the insurance carrier that.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

We break down the top advantages and disadvantages of life insurance by type to help you decide if life insurance is right for you.

In particular, millennials overestimate by more than five times the actual price.1.

The truth is, life insurance can be life insurance has many advantages, but there.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Create your own private bank using whole life insurance and gain 5 important advantages discussed in this video.

10 advantages of term life insurance.

Although term insurance is not always the most effective type of life insurance for all of a client's death benefit needs, it can still be useful in many circumstances.

Advantages of term life insurance.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

However, options to renew the policies are often available.

Life insurance is an important addition to your financial portfolio.

With various types of life insurance plans available, you can plan your financial goals.

Advantages of life insurance investing.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

Life insurance can be an important part of your financial strategy.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

Term life insurance has distinct advantages over other policies, but it comes with a few compare term life providers learn more.

Term life insurance is temporary with policies lasting choose from five different term life insurance plans with assumption life.

Get a free quote on policyme.

Some of the advantages of whole life insurance have to do with its cash value, the held liquidity, and the fact that policy owners can legitimately save for the future.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Term life insurance offers four important advantages.

There are advantages to specific policies that may not exist if you buy a different type of plan.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

With regard to life insurance, do you find that a lot of your clients don't have enough life insurance?

They are very limited in funds, usually life insurance is.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

In a cost efficient manner.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

Establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit works, it simply means that you set up a trust which now owns your life insurance policy and distributes the funds according to the terms of the trust.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Life insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death.

Shopping for life insurance can be a deeply personal experience.

It is, after all, your family that you want to protect.

The life insurance policy gives full financial support to the dependent in case the death of the insured which helps to eliminate the dependency of explain any five advantages of insurance.

Let's look at the advantages and disadvantages of term life insurance.

Term life insurance is probably the most popular form of protection because of its lowest cost. 5 Advantages Of Life Insurance. Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.5 Makanan Pencegah Gangguan PendengaranResep Selai Nanas HomemadeResep Kreasi Potato Wedges Anti GagalTrik Menghilangkan Duri Ikan BandengNikmat Kulit Ayam, Bikin SengsaraSejarah Nasi Megono Jadi Nasi TentaraSusu Penyebab Jerawat???Ternyata Jajanan Pasar Ini Punya Arti RomantisTernyata Kue Apem Bukan Kue Asli IndonesiaResep Ayam Kecap Ala CeritaKuliner

Comments

Post a Comment