5 Benefits Of Life Insurance Hdfc Life Insurance Company Limited.

5 Benefits Of Life Insurance. The Section 80c Of The.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

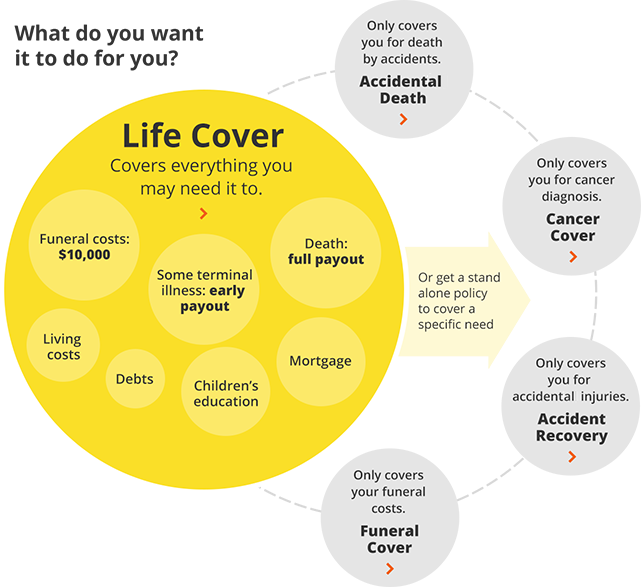

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Click now to read top 5 benefits of life insurance benefits.

The section 80c of the.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

Learn about the several life insurance option to receive guaranteed income from 2nd year onwards2.

Life insurance cover4 for financial security of your family.

Benefits of life insurance for individuals.

Here, the policy may be utilized as a business continuation plan.

This way, if the sole.

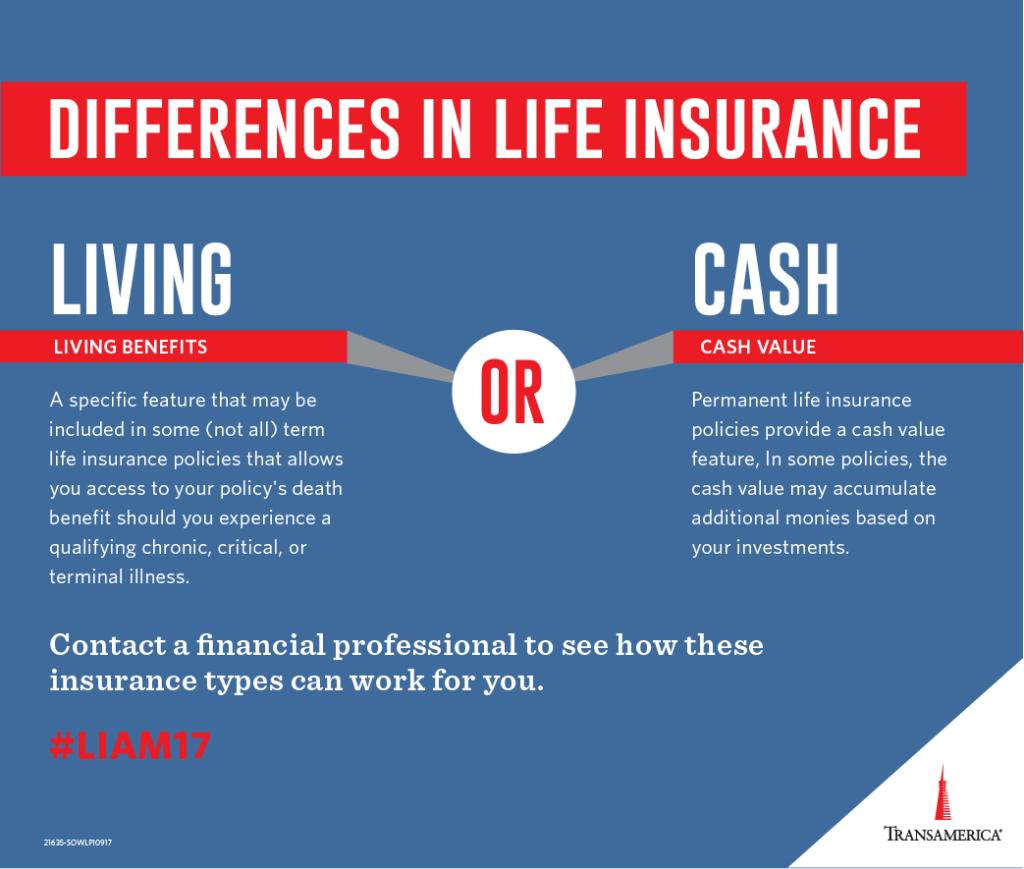

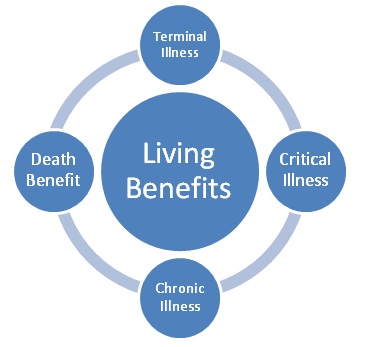

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Some life insurance policies have optional features, called riders, sometimes available at an additional cost, that let you.

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

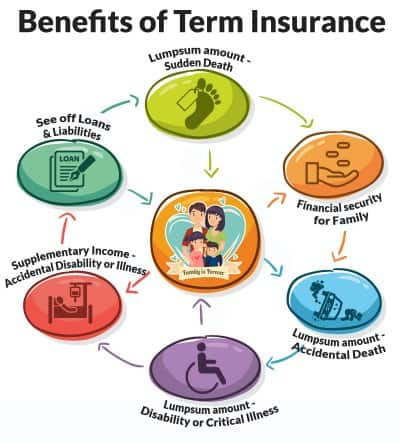

What are the benefits of term life insurance?

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

This means that if the policyholder is.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

We often think of life insurance as providing benefits to our loved ones after we pass away.

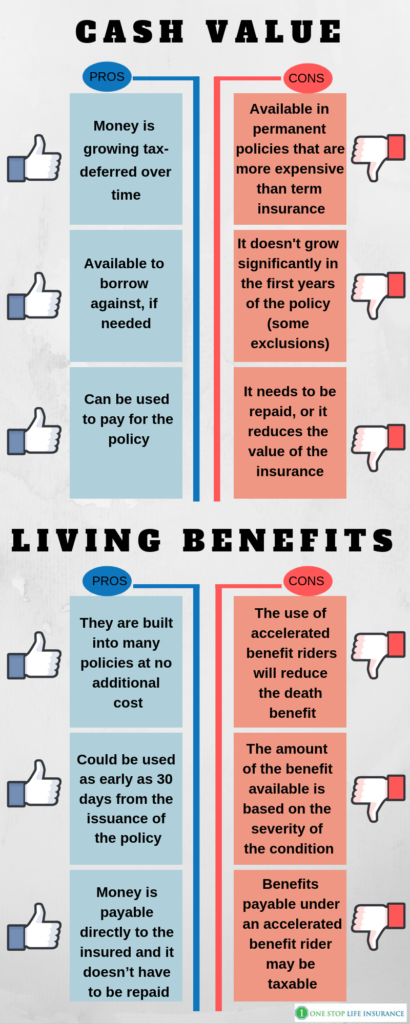

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

To get tax deduction under section 80c, the premium of a life insurance.

(as you get older, life insurance generally becomes more expensive.) with our whole life insurance plan, your premium rate will lock in and never increase also, keep in mind that one of the benefits of whole life insurance is that it builds cash value over time.

That's because each time you pay your.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

The endowment life insurance plan has all benefits of a term insurance plan.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

The scammer will trick you into believing that you are eligible for benefits of another person's policy and that the said person passed away, leaving you eligible to claim insurance.

7 benefits of life insurance for the wealthy.

By chris huntley on march 24, 2021.

For those unfamiliar with how an ilit.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

Life insurance is significantly cheaper when you're young, and if you buy a term life insurance policy, you can roll it over into permanent coverage when you're almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

It's also a sort of savings or investing vehicle.

Because of the risk, universal life insurance is typically cheaper than whole life insurance.

One potential benefit of universal life is that the premium is somewhat flexible.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`6 Khasiat Cengkih, Yang Terakhir Bikin HebohPentingnya Makan Setelah OlahragaTips Jitu Deteksi Madu Palsu (Bagian 2)Tips Jitu Deteksi Madu Palsu (Bagian 1)Ternyata Merokok + Kopi Menyebabkan KematianAwas!! Ini Bahaya Pewarna Kimia Pada MakananMengusir Komedo Membandel - Bagian 2Ternyata Tidur Terbaik Cukup 2 Menit!Mengusir Komedo MembandelEach life insurance living benefits company has guidelines regarding the specific requirements of the rider. 5 Benefits Of Life Insurance. The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Term life insurance and whole life insurance are the two most common types of life insurance.

Term life insurance offers policyholders a benefit only plan.

Typically, term policies remain in effect from five to 30 years, depending on the term you.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

The younger and healthier you are it's important to compare various types of life insurance to find the policy that's right for you and your financial situation.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul's powerful annual reset life insurance agents who strongly favor whole life (vs.

The pros of life insurance include:

But would you want to leave your family and loved ones with your financial burdens?.

Endowment life insurance is a way to save for your childs college education.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

How life insurance needs can change over time.

This is an important question and life insurance shoppers need to understand the pros and cons of term life insurance.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the.

Everyone deserves a secure financial future — and that's why life insurance is so important.

Whether you're just starting out or you're getting ready to retire, a life.

Pros & cons of life insurance.

There's a lot of confusing terminology, and different types of permanent policies can be complicated.

Pat is insured with a life insurance policy and karen is his primary beneficiary.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Types of life insurance are generally broken up into four categories:

Term life, whole life, universal life and variable universal life policies.

Understanding the difference between different kinds of life insurance and their pros and cons given your circumstances will enable you to reach the goals for.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

Want to save money on your life insurance premiums?

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

Universal life insurance offers lifelong protection with a range of investment options.

Your beneficiaries will still get a death benefit after you die.

Look at sample life insurance rates for term life, universal life, and whole life.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Clear your basics of life insurance that helps you understand & choose most life insurance plans provide considerable returns during maturity, thus making it an attractive this way one can easily weigh the pros and cons and finally can choose the right insurance plan that.

There are also universal life insurance plans that differ from the 2.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Having life insurance is a necessary part of your overall financial plan.

5star life insurance company is committed to providing the highest level of service.

We can be reached on our toll free customer service number:

You must be a lawful resident of the us that has lived here for at least pros of ladder life insurance.

Who is permanent life best for?

Pros and cons of permanent.

Other types of life insurance policies.

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

In traditional insurance plans, the premium amount remains flat from start to conclusion. 5 Benefits Of Life Insurance. Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.Nanas, Hoax Vs FaktaCegah Alot, Ini Cara Benar Olah Cumi-CumiResep Ayam Suwir Pedas Ala CeritaKuliner7 Makanan Pembangkit LibidoResep Selai Nanas Homemade9 Jenis-Jenis Kurma TerfavoritResep Garlic Bread Ala CeritaKuliner Ampas Kopi Jangan Buang! Ini ManfaatnyaIkan Tongkol Bikin Gatal? Ini PenjelasannyaBuat Sendiri Minuman Detoxmu!!

Comments

Post a Comment