5 Benefits Of Life Insurance How Can Life Insurance Help?

5 Benefits Of Life Insurance. Life Insurance Benefits Can Help Replace Your Income If You Pass Away.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

Benefits of universal life insurance.

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their many sole proprietors can also utilize the benefits of life insurance.

This way, if the sole.

Learn about the several life insurance option to receive guaranteed income from 2nd year onwards2.

Life insurance cover4 for financial security of your family.

How can life insurance help?

Some life insurance policies have optional features, called riders, sometimes available at an additional cost, that let you.

Gerber life whole life insurance provides financial protection for you and for your family when you're no longer here.

Here are the top five benefits of whole life insurance for you to consider

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

What are the benefits of term life insurance?

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Term life insurance is a kind of life insurance plan that provides death coverage to policyholders for a specific time limit.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Fortunately, there is a solution!

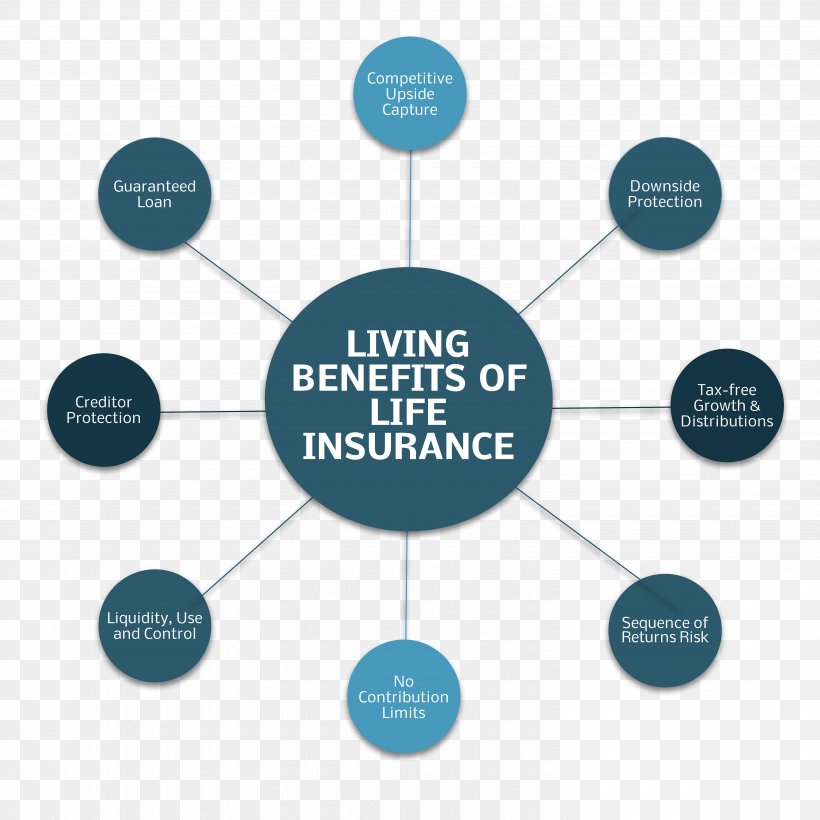

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

This means that if the policyholder is.

A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

There are certain restrictions related to the income tax benefits of life insurance policy, imposed by the ministry of finance [2].

To get tax deduction under section 80c, the premium of a life insurance.

Group life insurance coverage is usually based on your salary, and depending on how much financial support your family needs, you may need more coverage almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

7 benefits of life insurance for the wealthy.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

Unlike term life insurance, permanent life insurance isn't just a death benefit.

It's also a sort of savings or investing vehicle.

One potential benefit of universal life is that the premium is somewhat flexible.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Pat is insured with a life insurance policy and karen is his primary beneficiary.

Which policy provision will protect the rights of the contingent beneficiary to receive the policy benefits?

Variable universal life ties the benefits of a variable life policy with the benefits of a universal life policy.

It offers you more flexibility with how you handle your life insurance and the investments that come along with a vul policy.

Life insurance policies last till the end of the policy term chosen by you at the time of purchase or till a claim is paid as per the terms and conditions of the policy.

Are you aware of the benefits of health insurance?

Ini Cara Benar Cegah HipersomniaTernyata Madu Atasi InsomniaManfaat Kunyah Makanan 33 KaliHindari Makanan Dan Minuman Ini Kala Perut KosongIni Manfaat Seledri Bagi KesehatanVitalitas Pria, Cukup Bawang Putih SajaTernyata Jangan Sering Mandikan BayiGawat! Minum Air Dingin Picu Kanker!Tips Jitu Deteksi Madu Palsu (Bagian 2)Sehat Sekejap Dengan Es BatuDo you believe that you will never need health insurance because you are fit and fine? 5 Benefits Of Life Insurance. Cover for life threatening critical illnesses.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

Term life insurance and whole life insurance are the two most common types of life insurance.

Listed below are the pros and cons for each.

Typically, term policies remain in effect from five to 30 years, depending on the term you.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life being a hater of whole life insurance seems to automatically identify someone as being part of some club.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

The pros of life insurance include:

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

Endowment life insurance is a way to save for your childs college education.

Heres a look at the positives of a policy like this.

It is, after all, your family that you want to protect.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

We can be reached on our toll free customer service number:

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

Types of life insurance are generally broken up into four categories:

Understanding the difference between different kinds of life insurance and their pros and cons given your circumstances will enable you to reach the goals for.

Pros & cons of life insurance.

When you shop for life insurance, you're asked to choose between a term and a permanent policy.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

Universal life insurance is not a ripoff, but it had better make sense for what you're trying to accomplish.

That's why i have a $2.5 million policy on myself.

Bestow life insurance offers term life insurance from 10 to 30 years in coverage, with death benefits from $50,000 to $1.5 million and rates starting at $10 per month.

U.s citizens between the ages of 18 and 60 are encouraged to apply, but only those in good or better health will be approved.

Start studying chapter 5 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

More and more life insurance companies are making the application process fast and easy.

The process involved a lengthy application, going over your answers with an insurance agent, and a pros and cons of guaranteed issue life insurance.

Whole life or permanent life insurance provides lifetime coverage that never expires.

There are also universal life insurance plans that differ from the 2.

Check out the pros, cons and sample premiums that fabric offers for term life.

The aarp life insurance program features policies issued by new york life for the group's members.

Anyone age 50 or older can join.

Fewer than the expected number of complaints to state regulators.

Mortgage protection insurance (mpi) is similar to life insurance, with one major difference:

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

Want to save money on your life insurance premiums?

Read our top 5 tips.

Life insurance can offer protection and flexibility to your financial strategy.

Pros and cons of life insurance held inside hostplus super.

Review hostplus life insurance products and determine if you should buy additional insurance.

Learn about the pros & cons of life insurance inside your smsf.

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

Being familiar with these will help you decide which life at life wealth win, we'll help you decide what type of life insurance is better for you.

We will discuss the pros and cons of each kind of life insurance.

Who is permanent life best for?

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life. 5 Benefits Of Life Insurance. Clear your basics of life insurance that helps you understand & choose most life insurance plans provide considerable returns during maturity, thus making it an attractive this way one can easily weigh the pros and cons and finally can choose the right insurance plan that.Buat Sendiri Minuman Detoxmu!!3 Cara Pengawetan CabaiTernyata Kue Apem Bukan Kue Asli IndonesiaSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat5 Cara Tepat Simpan TelurSejarah Nasi Megono Jadi Nasi TentaraPetis, Awalnya Adalah Upeti Untuk RajaBir Pletok, Bir Halal BetawiAmpas Kopi Jangan Buang! Ini ManfaatnyaPecel Pitik, Kuliner Sakral Suku Using Banyuwangi

Comments

Post a Comment