5 Benefits Of Life Insurance This Means Your Beneficiaries Could Use The Money To Help Cover Essential Expenses, Such As Paying A Mortgage Or College Tuition For Your Children.

5 Benefits Of Life Insurance. Life Insurance Payouts Are Usually Fast.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

But generally, the more life insurance you have, the more benefits it will provide to your family when needed.

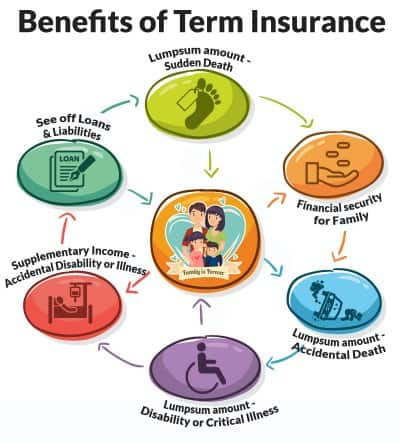

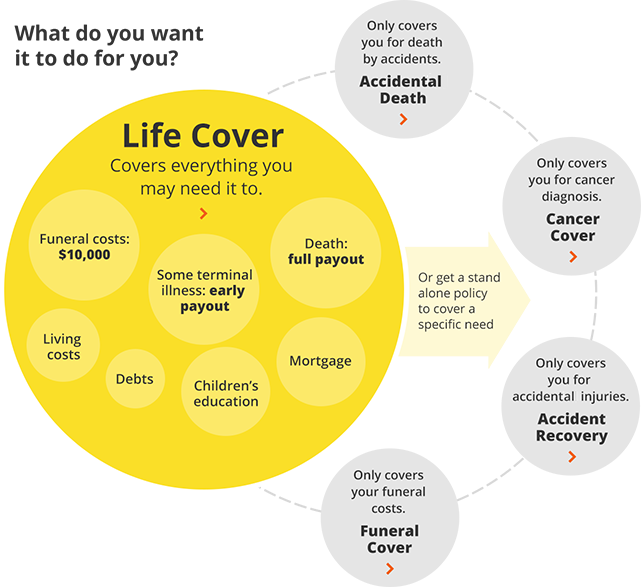

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

Click now to read top 5 benefits of life insurance benefits.

The section 80c of the.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

Learn about the several life insurance option to receive guaranteed income from 2nd year onwards2.

Life insurance cover4 for financial security of your family.

Benefits of life insurance for individuals.

Here, the policy may be utilized as a business continuation plan.

This way, if the sole.

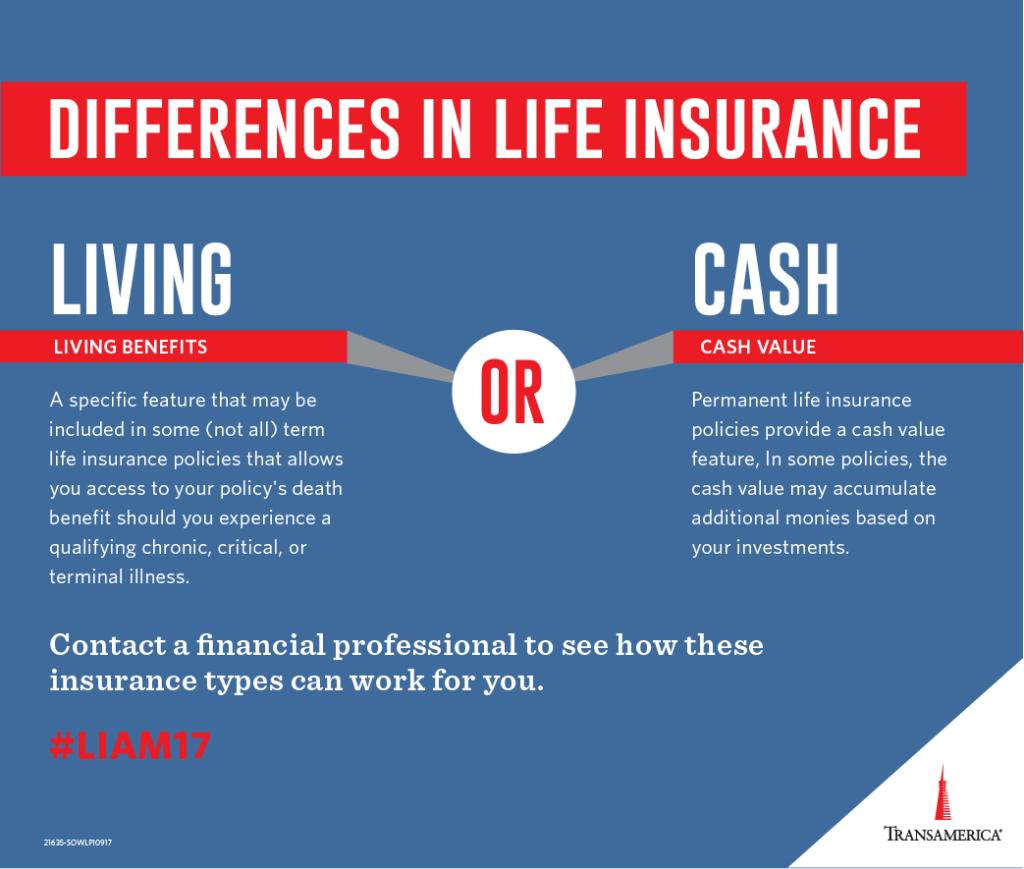

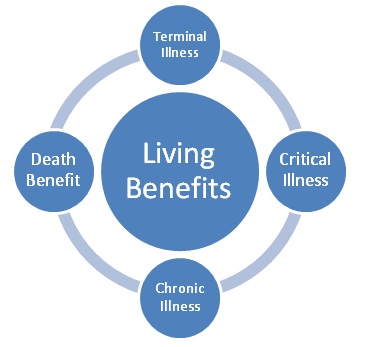

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Some life insurance policies have optional features, called riders, sometimes available at an additional cost, that let you.

The main types of life insurance are term life, whole life and universal life.

And within each of those types are further varieties.

What are the benefits of term life insurance?

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

This means that if the policyholder is.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

We often think of life insurance as providing benefits to our loved ones after we pass away.

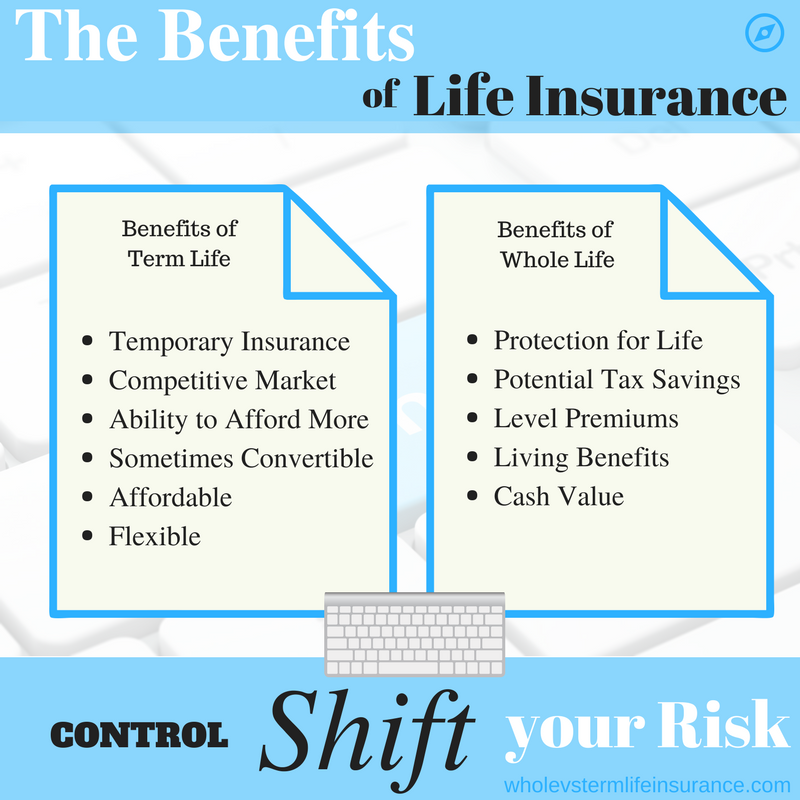

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Life insurance is protection nearly everyone is going to need at some point in his or her life, henson says.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

What is more, this is an easily preventable outcome.

To get tax deduction under section 80c, the premium of a life insurance.

(as you get older, life insurance generally becomes more expensive.) with our whole life insurance plan, your premium rate will lock in and never increase also, keep in mind that one of the benefits of whole life insurance is that it builds cash value over time.

That's because each time you pay your.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

The endowment life insurance plan has all benefits of a term insurance plan.

An endowment policy allows the policyholder to receive a lump sum amount on the maturity date if he stays alive till the maturity date.

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium paid is eligible for deduction under section 80c of the income tax act, 1961.

The scammer will trick you into believing that you are eligible for benefits of another person's policy and that the said person passed away, leaving you eligible to claim insurance.

7 benefits of life insurance for the wealthy.

By chris huntley on march 24, 2021.

For those unfamiliar with how an ilit.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

Life insurance is significantly cheaper when you're young, and if you buy a term life insurance policy, you can roll it over into permanent coverage when you're almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're.

Life insurance, an online life insurance agency, we want to give you an honest, noninvasive way to research, study, and examine our for your benefit coach b.

It's also a sort of savings or investing vehicle.

Because of the risk, universal life insurance is typically cheaper than whole life insurance.

One potential benefit of universal life is that the premium is somewhat flexible.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Cara Baca Tanggal Kadaluarsa Produk MakananMulti Guna Air Kelapa HijauPD Hancur Gegara Bau Badan, Ini Solusinya!!5 Manfaat Meredam Kaki Di Air EsTernyata Ini Beda Basil Dan Kemangi!!Ternyata Tahan Kentut Bikin Keracunan3 X Seminggu Makan Ikan, Penyakit Kronis MinggatObat Hebat, Si Sisik NagaMengusir Komedo Membandel5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuEach life insurance living benefits company has guidelines regarding the specific requirements of the rider. 5 Benefits Of Life Insurance. The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

It's possible to own more.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

Being a hater of whole life insurance seems to automatically identify someone as being part of some club.

Benzinga can help you pick the best life insurance for you in 2021.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life insurance.

But would you want to leave your family and loved ones with your financial burdens?.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul), that only exaggerate the bad and the cons of indexed universal life insurance to suit.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

Buy from a reputable life insurance company your life insurance policy is meant to financially protect the people you love when you are no longer.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

5 best life insurance companies.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

Pros & cons of life insurance.

When you shop for life insurance, you're asked to choose between a term and a permanent policy.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

5star life insurance company is committed to providing the highest level of service.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Ladder controls the underwriting and risk analysis, which means they are able to return.

Bestow life insurance offers term life insurance from 10 to 30 years in coverage, with death benefits from $50,000 to $1.5 million and rates starting at $10 per month.

U.s citizens between the ages of 18 and 60 are encouraged to apply, but only those in good or better health will be approved.

Read our top 5 tips.

The pros of term life insurance are the affordable premiums, optional riders that can broaden the coverage, and the ability to convert the policy to pro:

Each policy contains a cash value account and the cash can be accessed by the policy owner for any reason.

Term life insurance provides coverage for a set period of time, usually around 20 to 30 years.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

The insurance company's ease of use through its online portal enables the cost of life insurance depends on a number of factors like age, general health, medical conditions and the type of policy selected.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

This fintech issues term life insurance in minutes for those aged 21 to 54.

Learn about its pros, cons and costs now.

You'll have your pick of coverage amounts ranging from $50,000 to $1.5 million and lasting 10, 15, 20, 25 or 30 years.

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

Anyone age 50 or older can join.

Term life insurance premiums rise every five years.

Fewer than the expected number of complaints to state regulators.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period the cons of whole life it has a higher monthly outlay and difficult to qualify.

The pros of whole life.

Pros and cons of permanent.

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Pros and cons of life insurance held inside hostplus super.

Learn about the pros & cons of life insurance inside your smsf.

While premiums may be tax deductible to the fund, benefit payouts.

Learn about the pros & cons of life insurance inside your smsf. 5 Benefits Of Life Insurance. While premiums may be tax deductible to the fund, benefit payouts.Bir Pletok, Bir Halal BetawiPetis, Awalnya Adalah Upeti Untuk RajaTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiTernyata Jajanan Pasar Ini Punya Arti RomantisResep Garlic Bread Ala CeritaKuliner Trik Menghilangkan Duri Ikan BandengIni Beda Asinan Betawi & Asinan BogorResep Cream Horn PastryResep Racik Bumbu Marinasi IkanStop Merendam Teh Celup Terlalu Lama!

Comments

Post a Comment