5 Pros Of Life Insurance However, Each Life Insurance Company Handles Burial Insurance And Final Expense Insurance Pros & Cons Of Guaranteed Acceptance.

5 Pros Of Life Insurance. So If You Start Off Paying $20 A Month, You'll.

SELAMAT MEMBACA!

Term life insurance and whole life insurance are the two most common types of life insurance.

Term life insurance offers policyholders a benefit only plan.

Typically, term policies remain in effect from five to 30 years, depending on the term you.

Why choose indexed universal life insurance (iul)?

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul), that only exaggerate the bad and the cons of indexed universal life insurance to suit.

The pros of life insurance include:

But would you want to leave your family and loved ones with your financial burdens?.

Heres a look at the positives of a policy like this.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

This is an important question and life insurance shoppers need to understand the pros and cons of term life insurance.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the.

You'll probably need a portion of life insurance proceeds for near term expenses, but you should try to make sure that you have at least 50% left for investing.

Pat is insured with a life insurance policy and karen is his primary beneficiary.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Life insurance policies are offered by the insurer to protect the income and earning potential of the insured.

If the insured passes away, the beneficiaries yes, universal life insurance policies can last you the rest of your life.

However, this depends on the returns of those invested savings and the.

Types of life insurance are generally broken up into four categories:

Term life, whole life, universal life and understanding the difference between different kinds of life insurance and their pros and cons given.

Pros & cons of life insurance.

There's a lot of confusing terminology, and different types of permanent policies can be complicated.

Term life insurance provides coverage for a set period of time, usually around 20 to 30 years.

The goal is to protect your beneficiaries financially should you die during your working years.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

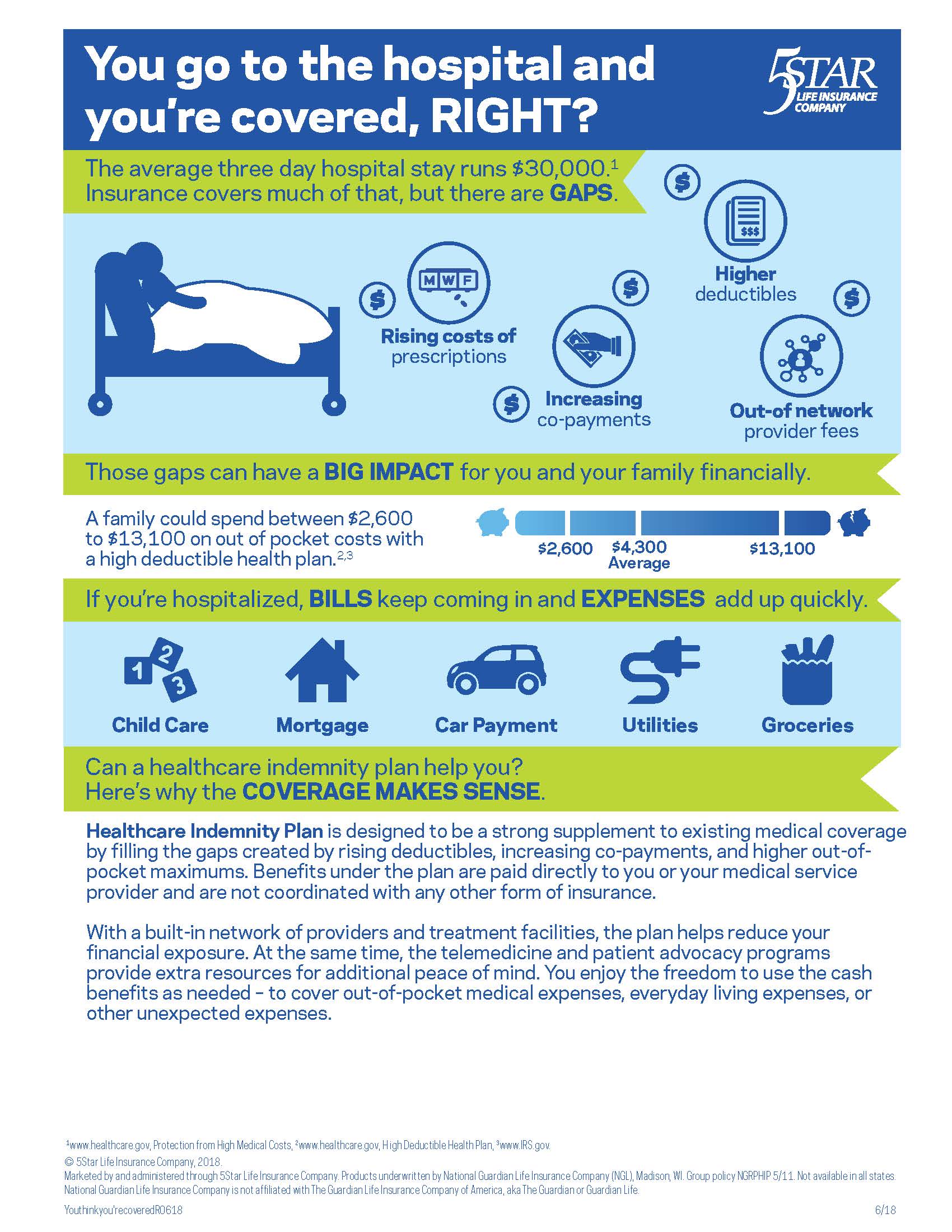

5star life insurance company is committed to providing the highest level of service.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Each policy contains a cash value account and the cash can be accessed by the policy owner for any reason.

Universal life insurance is a.

Shopping for life insurance can be a deeply personal experience.

Universal life insurance is not a ripoff, but it had better make sense for what you're trying to accomplish.

For example, i've seen these type of policies used for estate planning purposes to pass more i'm a huge proponent of life insurance.

That's why i have a $2.5 million policy on myself.

There are also universal life insurance plans that differ from the 2.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life.

Anyone age 50 or older can join.

Term life insurance premiums rise every five years.

Fewer than the expected number of complaints to state regulators.

Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

The cost of life insurance is very competitive in new zealand and the existence of price comparison websites to show quotes makes it more affordable than ever before.

Mortgage protection insurance (mpi) is similar to life insurance, with one major difference:

The coverage amount and length.

However, each life insurance company handles burial insurance and final expense insurance pros & cons of guaranteed acceptance.

2020 top 10 best burial and final expense insurance this type of life insurance coverage is sometimes called burial expense insurance, final expense insurance.

Allianz offers term insurance and fixed index universal life insurance.

Want to save money on your life insurance premiums?

Read our top 5 tips.

Pros and cons of permanent.

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

How easy is it to get life insurance if you're considered high risk?

Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

How easy is it to get life insurance if you're considered high risk? 5 Pros Of Life Insurance. Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

Term life insurance and whole life insurance are the two most common types of life insurance.

Term life insurance offers policyholders a benefit only plan.

Typically, term policies remain in effect from five to 30 years, depending on the term you.

Why choose indexed universal life insurance (iul)?

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul), that only exaggerate the bad and the cons of indexed universal life insurance to suit.

The pros of life insurance include:

But would you want to leave your family and loved ones with your financial burdens?.

Heres a look at the positives of a policy like this.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

This is an important question and life insurance shoppers need to understand the pros and cons of term life insurance.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the.

You'll probably need a portion of life insurance proceeds for near term expenses, but you should try to make sure that you have at least 50% left for investing.

Pat is insured with a life insurance policy and karen is his primary beneficiary.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Life insurance policies are offered by the insurer to protect the income and earning potential of the insured.

If the insured passes away, the beneficiaries yes, universal life insurance policies can last you the rest of your life.

However, this depends on the returns of those invested savings and the.

Types of life insurance are generally broken up into four categories:

Term life, whole life, universal life and understanding the difference between different kinds of life insurance and their pros and cons given.

Pros & cons of life insurance.

There's a lot of confusing terminology, and different types of permanent policies can be complicated.

Term life insurance provides coverage for a set period of time, usually around 20 to 30 years.

The goal is to protect your beneficiaries financially should you die during your working years.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

5star life insurance company is committed to providing the highest level of service.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Each policy contains a cash value account and the cash can be accessed by the policy owner for any reason.

Universal life insurance is a.

Shopping for life insurance can be a deeply personal experience.

Universal life insurance is not a ripoff, but it had better make sense for what you're trying to accomplish.

For example, i've seen these type of policies used for estate planning purposes to pass more i'm a huge proponent of life insurance.

That's why i have a $2.5 million policy on myself.

There are also universal life insurance plans that differ from the 2.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life.

Anyone age 50 or older can join.

Term life insurance premiums rise every five years.

Fewer than the expected number of complaints to state regulators.

Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

The cost of life insurance is very competitive in new zealand and the existence of price comparison websites to show quotes makes it more affordable than ever before.

Mortgage protection insurance (mpi) is similar to life insurance, with one major difference:

The coverage amount and length.

However, each life insurance company handles burial insurance and final expense insurance pros & cons of guaranteed acceptance.

2020 top 10 best burial and final expense insurance this type of life insurance coverage is sometimes called burial expense insurance, final expense insurance.

Allianz offers term insurance and fixed index universal life insurance.

Want to save money on your life insurance premiums?

Read our top 5 tips.

Pros and cons of permanent.

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

How easy is it to get life insurance if you're considered high risk?

Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

How easy is it to get life insurance if you're considered high risk? 5 Pros Of Life Insurance. Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

Comments

Post a Comment