5 Pros Of Life Insurance Term Life Insurance Policies Are Also Much More Affordable Than Whole, As The Policy Doesn't Have A Cash Value Until You.

5 Pros Of Life Insurance. Allianz Offers Term Insurance And Fixed Index Universal Life Insurance.

SELAMAT MEMBACA!

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

It's possible to own more.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

Being a hater of whole life insurance seems to automatically identify someone as being part of some club.

Benzinga can help you pick the best life insurance for you in 2021.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life insurance.

But would you want to leave your family and loved ones with your financial burdens?.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul), that only exaggerate the bad and the cons of indexed universal life insurance to suit.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

Buy from a reputable life insurance company your life insurance policy is meant to financially protect the people you love when you are no longer.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

5 best life insurance companies.

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

Pros & cons of life insurance.

When you shop for life insurance, you're asked to choose between a term and a permanent policy.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

5star life insurance company is committed to providing the highest level of service.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Ladder controls the underwriting and risk analysis, which means they are able to return.

Bestow life insurance offers term life insurance from 10 to 30 years in coverage, with death benefits from $50,000 to $1.5 million and rates starting at $10 per month.

U.s citizens between the ages of 18 and 60 are encouraged to apply, but only those in good or better health will be approved.

Read our top 5 tips.

The pros of term life insurance are the affordable premiums, optional riders that can broaden the coverage, and the ability to convert the policy to pro:

Each policy contains a cash value account and the cash can be accessed by the policy owner for any reason.

Term life insurance provides coverage for a set period of time, usually around 20 to 30 years.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

The insurance company's ease of use through its online portal enables the cost of life insurance depends on a number of factors like age, general health, medical conditions and the type of policy selected.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

This fintech issues term life insurance in minutes for those aged 21 to 54.

Learn about its pros, cons and costs now.

You'll have your pick of coverage amounts ranging from $50,000 to $1.5 million and lasting 10, 15, 20, 25 or 30 years.

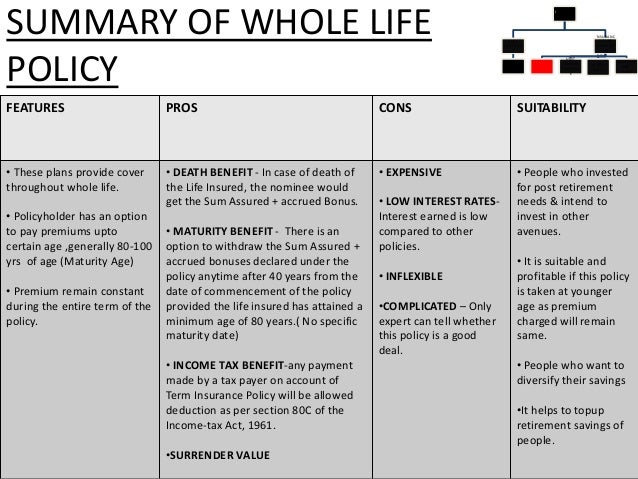

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

Anyone age 50 or older can join.

Term life insurance premiums rise every five years.

Fewer than the expected number of complaints to state regulators.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period the cons of whole life it has a higher monthly outlay and difficult to qualify.

The pros of whole life.

Pros and cons of permanent.

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Pros and cons of life insurance held inside hostplus super.

Learn about the pros & cons of life insurance inside your smsf.

While premiums may be tax deductible to the fund, benefit payouts.

3 X Seminggu Makan Ikan, Penyakit Kronis MinggatMengusir Komedo Membandel - Bagian 2Tips Jitu Deteksi Madu Palsu (Bagian 1)Ternyata Madu Atasi InsomniaSaatnya Minum Teh Daun Mint!!Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatResep Alami Lawan Demam AnakPD Hancur Gegara Bau Badan, Ini Solusinya!!Multi Guna Air Kelapa Hijau6 Khasiat Cengkih, Yang Terakhir Bikin HebohLearn about the pros & cons of life insurance inside your smsf. 5 Pros Of Life Insurance. While premiums may be tax deductible to the fund, benefit payouts.

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

It's possible to own more.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

Being a hater of whole life insurance seems to automatically identify someone as being part of some club.

Benzinga can help you pick the best life insurance for you in 2021.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life insurance.

But would you want to leave your family and loved ones with your financial burdens?.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg)

Iul), that only exaggerate the bad and the cons of indexed universal life insurance to suit.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

Buy from a reputable life insurance company your life insurance policy is meant to financially protect the people you love when you are no longer.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

5 best life insurance companies.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

Pros & cons of life insurance.

When you shop for life insurance, you're asked to choose between a term and a permanent policy.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

5star life insurance company is committed to providing the highest level of service.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Ladder controls the underwriting and risk analysis, which means they are able to return.

Bestow life insurance offers term life insurance from 10 to 30 years in coverage, with death benefits from $50,000 to $1.5 million and rates starting at $10 per month.

U.s citizens between the ages of 18 and 60 are encouraged to apply, but only those in good or better health will be approved.

Read our top 5 tips.

The pros of term life insurance are the affordable premiums, optional riders that can broaden the coverage, and the ability to convert the policy to pro:

Each policy contains a cash value account and the cash can be accessed by the policy owner for any reason.

Term life insurance provides coverage for a set period of time, usually around 20 to 30 years.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

The insurance company's ease of use through its online portal enables the cost of life insurance depends on a number of factors like age, general health, medical conditions and the type of policy selected.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

This fintech issues term life insurance in minutes for those aged 21 to 54.

Learn about its pros, cons and costs now.

You'll have your pick of coverage amounts ranging from $50,000 to $1.5 million and lasting 10, 15, 20, 25 or 30 years.

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

Anyone age 50 or older can join.

Term life insurance premiums rise every five years.

Fewer than the expected number of complaints to state regulators.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period the cons of whole life it has a higher monthly outlay and difficult to qualify.

The pros of whole life.

Pros and cons of permanent.

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Pros and cons of life insurance held inside hostplus super.

Learn about the pros & cons of life insurance inside your smsf.

While premiums may be tax deductible to the fund, benefit payouts.

Learn about the pros & cons of life insurance inside your smsf. 5 Pros Of Life Insurance. While premiums may be tax deductible to the fund, benefit payouts.Pecel Pitik, Kuliner Sakral Suku Using BanyuwangiTips Memilih Beras BerkualitasResep Cumi Goreng Tepung MantulTernyata Jajanan Pasar Ini Punya Arti RomantisResep Kreasi Potato Wedges Anti Gagal3 Cara Pengawetan CabaiResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangFoto Di Rumah Makan PadangResep Yakitori, Sate Ayam Ala JepangBakwan Jamur Tiram Gurih Dan Nikmat

Comments

Post a Comment