5 Pros Of Life Insurance Though Term Life Insurance Is Simpler Than Whole Life Insurance, It Still Comes With Many Variations.

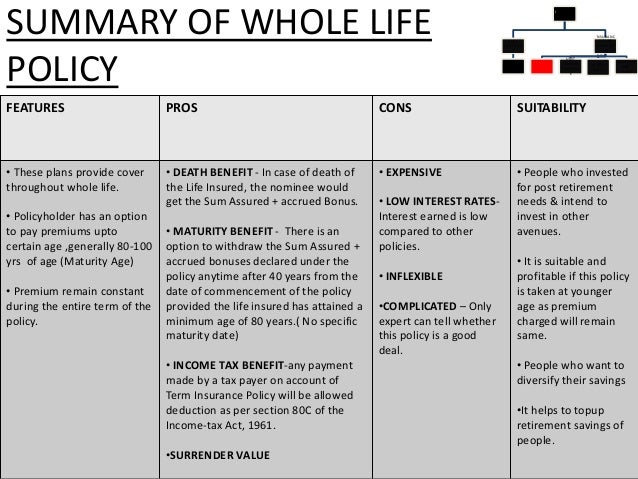

5 Pros Of Life Insurance. Modified Whole Life Insurance Entails A Lowered Amount Of Premium Due In The Earlier Years Of One's Contract.

SELAMAT MEMBACA!

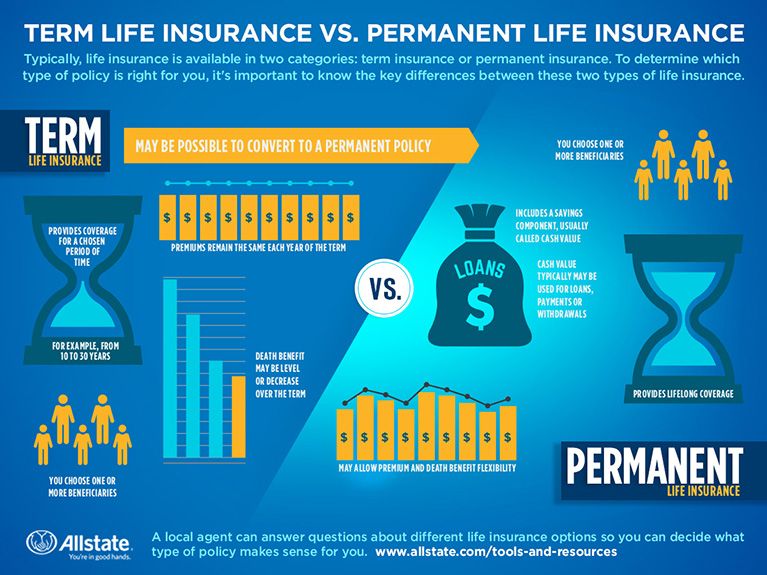

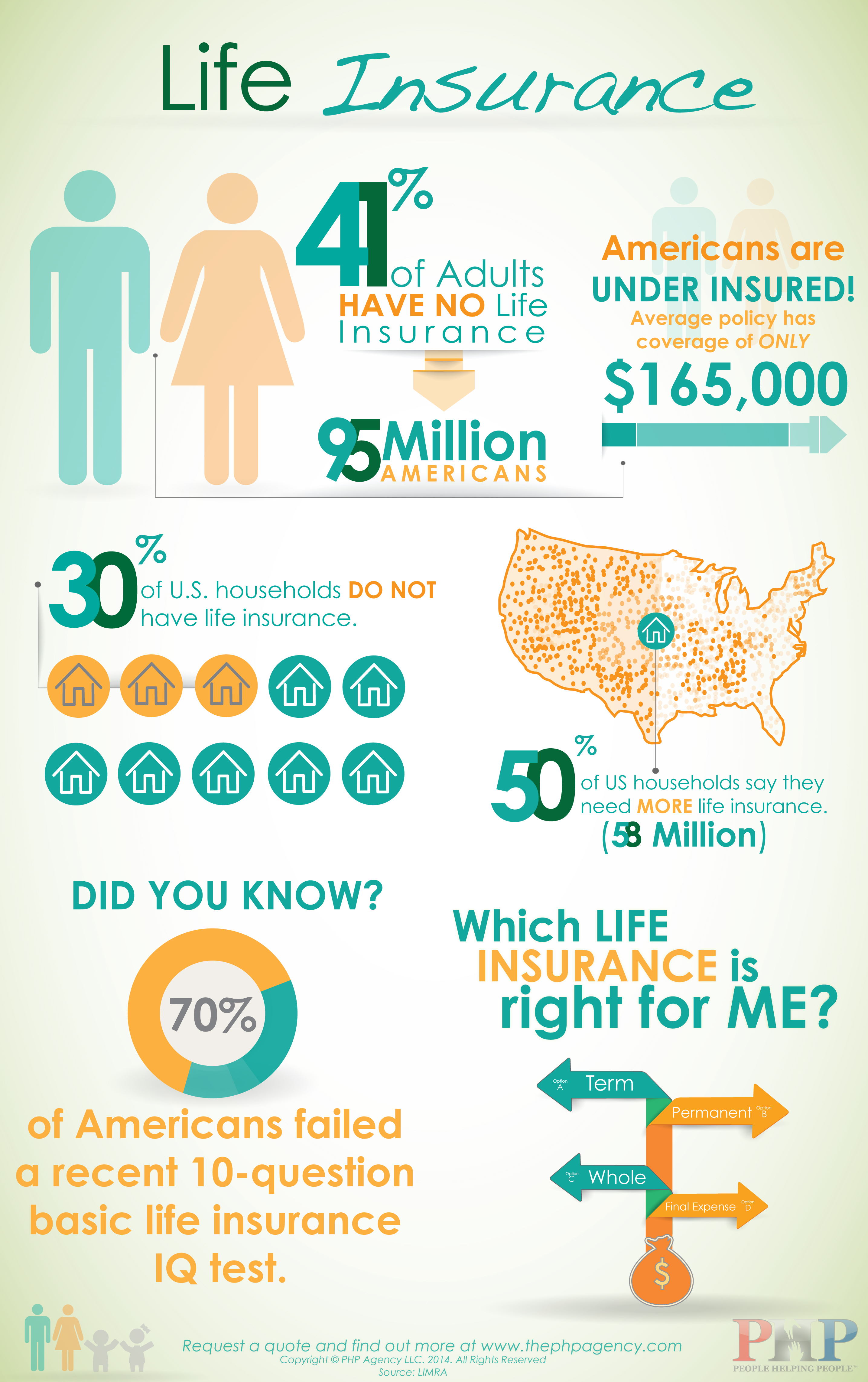

Term life insurance and whole life insurance are the two most common types of life insurance.

Term life insurance offers policyholders a benefit only plan.

Typically, term policies remain in effect from five to 30 years, depending on the term you.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

The younger and healthier you are it's important to compare various types of life insurance to find the policy that's right for you and your financial situation.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

Iul's powerful annual reset life insurance agents who strongly favor whole life (vs.

The pros of life insurance include:

But would you want to leave your family and loved ones with your financial burdens?.

Endowment life insurance is a way to save for your childs college education.

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

How life insurance needs can change over time.

This is an important question and life insurance shoppers need to understand the pros and cons of term life insurance.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the.

Everyone deserves a secure financial future — and that's why life insurance is so important.

Whether you're just starting out or you're getting ready to retire, a life.

Pros & cons of life insurance.

There's a lot of confusing terminology, and different types of permanent policies can be complicated.

Pat is insured with a life insurance policy and karen is his primary beneficiary.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Types of life insurance are generally broken up into four categories:

Term life, whole life, universal life and variable universal life policies.

Understanding the difference between different kinds of life insurance and their pros and cons given your circumstances will enable you to reach the goals for.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

Want to save money on your life insurance premiums?

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Uk specific factors, where to go for the best deals, how it compares with alternatives such as term life insurance, and the pros.

Universal life insurance offers lifelong protection with a range of investment options.

Your beneficiaries will still get a death benefit after you die.

Look at sample life insurance rates for term life, universal life, and whole life.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Clear your basics of life insurance that helps you understand & choose most life insurance plans provide considerable returns during maturity, thus making it an attractive this way one can easily weigh the pros and cons and finally can choose the right insurance plan that.

There are also universal life insurance plans that differ from the 2.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Having life insurance is a necessary part of your overall financial plan.

5star life insurance company is committed to providing the highest level of service.

We can be reached on our toll free customer service number:

You must be a lawful resident of the us that has lived here for at least pros of ladder life insurance.

Who is permanent life best for?

Pros and cons of permanent.

Other types of life insurance policies.

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

Ternyata Cewek Curhat Artinya SayangMulai Sekarang, Minum Kopi Tanpa Gula!!Saatnya Bersih-Bersih UsusTernyata Merokok + Kopi Menyebabkan KematianTernyata Jangan Sering Mandikan BayiKhasiat Luar Biasa Bawang Putih PanggangTernyata Madu Atasi InsomniaSalah Pilih Sabun, Ini Risikonya!!!Awas!! Ini Bahaya Pewarna Kimia Pada MakananManfaat Kunyah Makanan 33 KaliIn traditional insurance plans, the premium amount remains flat from start to conclusion. 5 Pros Of Life Insurance. Life insurance is a type of insurance contract which pays your dependants a fixed lump sum if you die during the term of the contract.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

Life insurance companies realize that every person wants to feel safe.

To protect yourself and your family, there are many types of insurance packages that certainly offers safety when an unexpected there are many advantages and disadvantages of life insurance policies that are described below.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance have both advantages and disadvantages.

Buying the life insurance is one of the best decisions that everyone should make in their life.

Life insurance gives you the peace of mind you need.

It is not unusual for people to think that their life insurance premiums are a waste of money list of the disadvantages of life insurance.

Life insurance policies can be extremely complicated.

Indexed universal life insurance (and universal life insurance, for that matter) has a lot of fees.

Just look at the above.

We have addressed those disappointments by describing the disadvantages of indexed universal life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Life insurance comes in many shapes and sizes and each has different advantages and disadvantages.

But there are two primary types of the cost of life insurance is based primarily on your age (when you buy the policy) and your health.

/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg)

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Although there are many benefits of life insurance, life insurance companies have lots of experience in minimizing their own risks, and life insurance.

The disadvantages of life insurance.

You should be healthy for affordable life insurance companies create premiums based on the risk of a payout.

Someone with a chronic disease or that skydives for a living, for example.

The disadvantage of life insurance is that for the vast majority the insureds do not match their survivor's need for cash upon their death with the 'right kind' of insurance plan.

According to wikipedia, life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium.

Many policies are flexible and allow you to adjust the coverage at any time and some types of policies provide accessible cash when you experience financial need.

These benefits are offset by the disadvantages.

The disadvantages of buying life insurance may be less obvious, but they still exist.

Here are some of the most common disadvantages

If we talk about the disadvantages of insurance, there are no such disadvantages.

1.9 disadvantages life insurance investments 1.11 your health may dictate the affordability of life insurance life insurance is like any other financial product.

When there are less risks for the provider.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

While life insurance is great in a lot of ways, it's not immune to some drawbacks.

The biggest one we can identify is the fact that you can't just buy it because you want to.

Advantages of life insurance life insurance provides a cash infusion to deal with the adverse financial consequences of the insured's death.

Death benefits may be exempt from estate taxes if the policy is properly owned.

Cash values increase deferred taxes over the life of the insured.

A health insurance policy is usually valid for a period of one year.

You need to take active measures in order to keep the policy active.

If you fail to renew the policy in time, you may face a lot of issues including financial losses.

The main disadvantage associated with term insurance is that your premiums increase every time coverage is renewed, because of the chance of.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Learn more in our guide.

Ul (universal life insurance) policy is a kind of life insurance product with a life equal to yours.

If you live for 95 years, it will last up to 95 years, and it will here are the top 7 disadvantages of universal life insurance:

You need to pay a higher premium for policies.

In the process, you also get some benefits from insuring your life.

As opposed to any other type of financial investment, you can get favorable treatment as it relates to tax.

Universal life insurance cash value will decline in the long run, but this is supposed to happen.

Life insurance plan is unique investments that will greatly help you to meet your needs saves the important goals in your life and protect your assets.

Here, you will know and learn the advantages and disadvantages of life insurance.

There are advantages to specific policies that may not exist if you buy a different type of plan.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Life insurance is most common and popular financial products carried out by the people.

There are many types of life insurances like term life insurance in us, life insurance is basically taken to be an investment item for consumption.

Companies often contract with other providers for services, such as billing and legal services.

People generally invest that leads to wide hybrid investments like. 5 Pros Of Life Insurance. Companies often contract with other providers for services, such as billing and legal services.Kuliner Jangkrik Viral Di JepangResep Ayam Kecap Ala CeritaKulinerTernyata Asal Mula Soto Bukan Menggunakan DagingSejarah Nasi Megono Jadi Nasi TentaraSejarah Gudeg JogyakartaResep Nikmat Gurih Bakso LeleSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanResep Cumi Goreng Tepung Mantul3 Jenis Daging Bahan Bakso Terbaik

Comments

Post a Comment