5 Benefits Of Life Insurance Maturity Benefits Of Most Insurance Policies Are Tax Free Under Section 10 (10d) And The Premium Paid Is Eligible For Deduction Under Section 80c Of The Income Tax Act, 1961.

5 Benefits Of Life Insurance. For Example, You'll Also Find Options For Living Benefits That Can Help Pay.

SELAMAT MEMBACA!

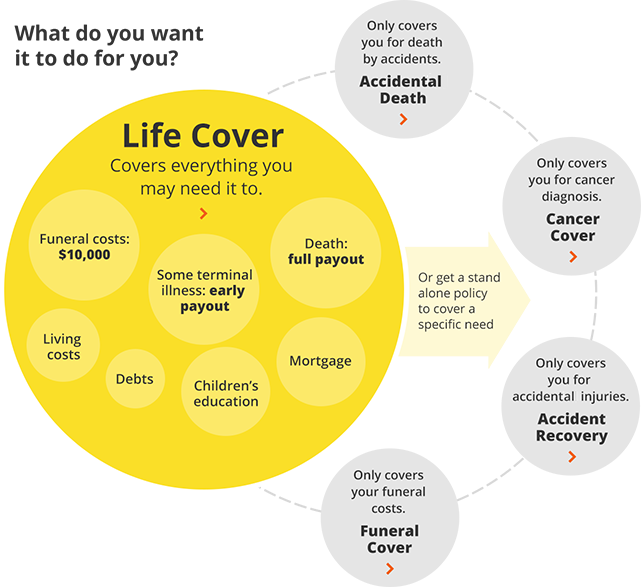

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Life insurance can be essential for protecting your family in the event of a tragedy.

It also has tax benefits and other uses.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

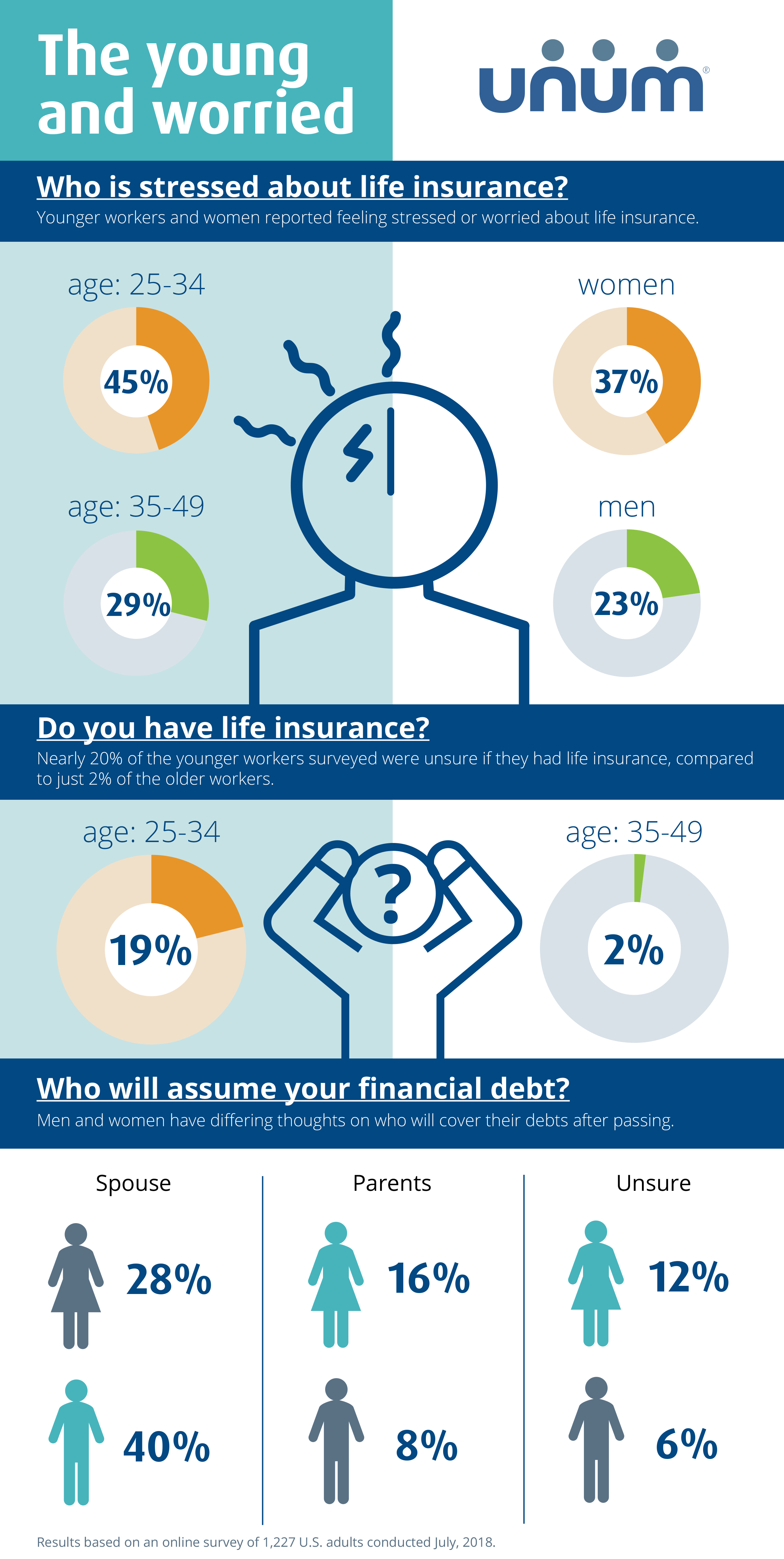

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

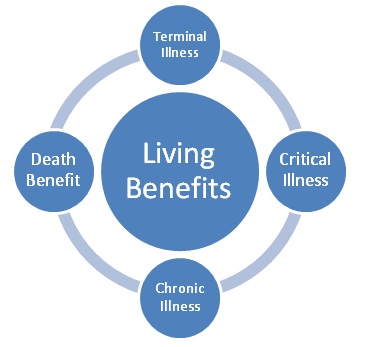

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

How can life insurance help?

Gerber life whole life insurance provides financial protection for you and for your family when you're no longer here.

Adults aged 18 to 70 may apply for a policy, and applying is easy.

Here are the top five benefits of whole life insurance for you to consider

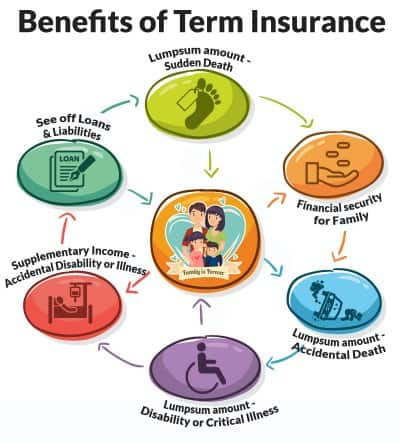

Life insurance cover4 for financial security of your family.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their monthly bills.

Here, the policy may be utilized as a business continuation plan.

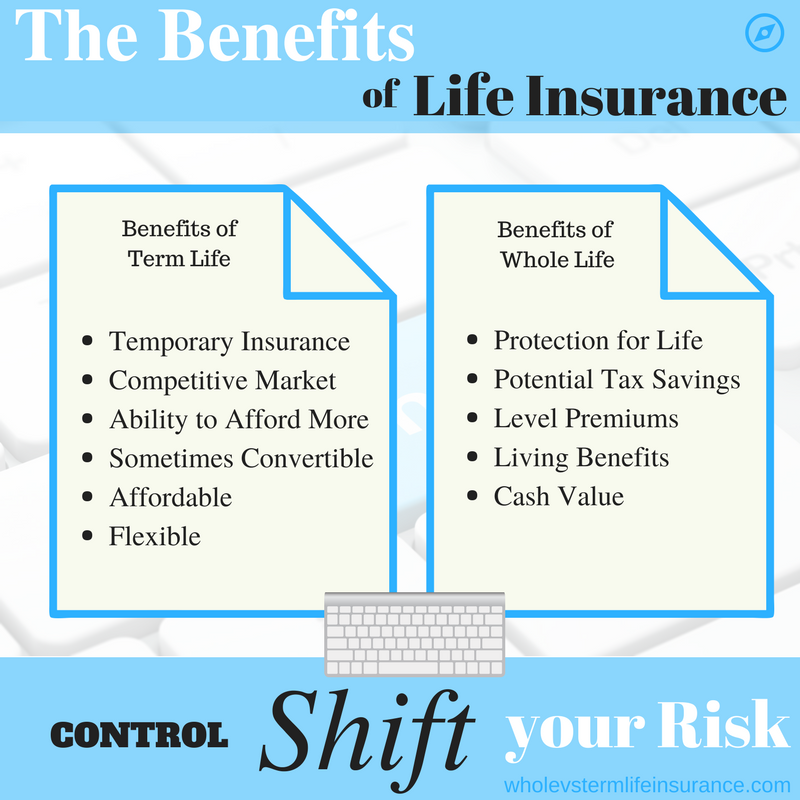

Term life insurance is a top choice for people who want to cover financial obligations that are common when raising a family.

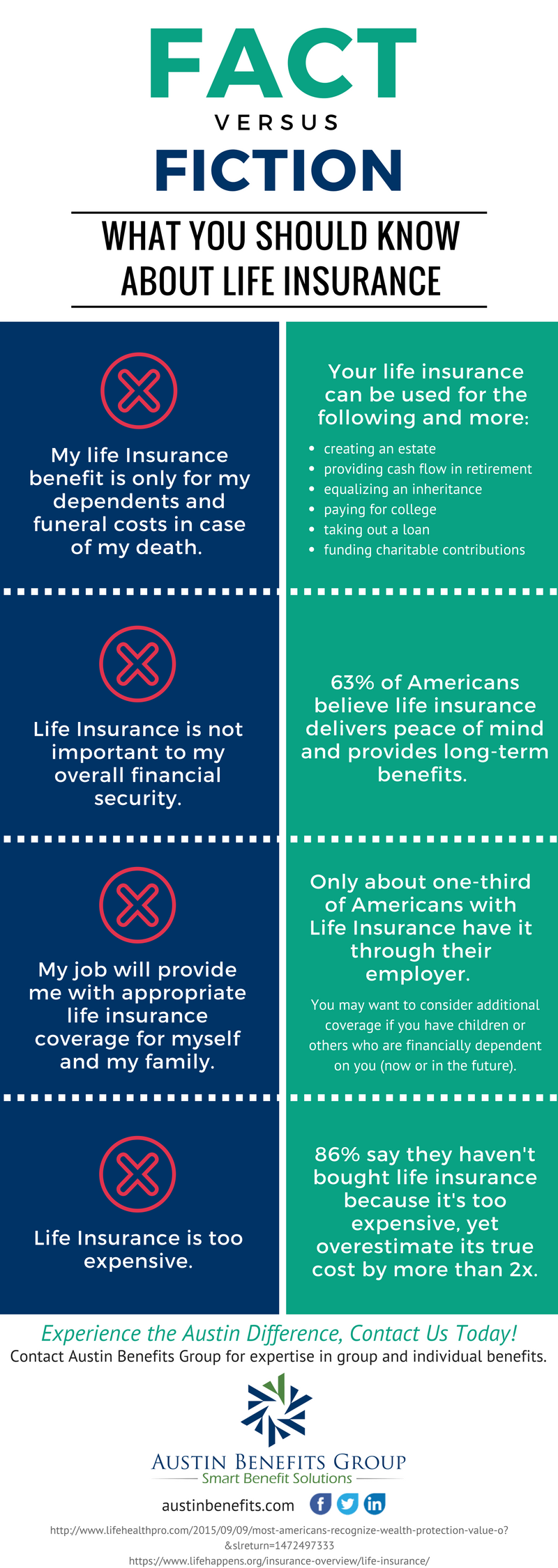

The main types of life insurance are term life, whole life and universal life.

With so many life insurance options, you can.

The endowment life insurance plan has all benefits of a term insurance plan.

As per this insurance plan, the accumulated funds through the premiums are collected as the insured's asset, the benefit of which is distributed regularly to the insured, after he takes a professional retirement.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Hdfc life insurance company limited.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

This type of insurance relieves the insured person's relatives of the.

If you die while your policy is in force, your policy pays a death your life insurance policy often provides more than just death benefits, though.

For example, you'll also find options for living benefits that can help pay.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Buying it as a gift for a child can be an affordable way to meet many.

What is an executive bonus plan, also known as an irs section 162 plan?

A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance.

To get tax deduction under section 80c, the premium of a life insurance.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Unlike term life insurance, permanent life insurance isn't just a death benefit.

It's also a sort of savings or investing vehicle.

One potential benefit of universal life is that the premium is somewhat flexible.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit.

To avail of this benefit, it is imperative to get admitted at any of the.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Tekanan Darah Tinggi, Hajar Pakai Cincau HijauFakta Salah Kafein KopiSegala Penyakit, Rebusan Ciplukan Obatnya5 Olahan Jahe Bikin SehatJam Piket Organ Tubuh (Ginjal)Gawat! Minum Air Dingin Picu Kanker!Awas!! Ini Bahaya Pewarna Kimia Pada MakananTernyata Ini Beda Basil Dan Kemangi!!5 Manfaat Posisi Viparita KaraniJam Piket Organ Tubuh (Paru-Paru)Group life insurance coverage is usually based on your salary, and depending on how much financial support your family needs, you may need more coverage almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard. 5 Benefits Of Life Insurance. Purchasing life insurance while you're.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Life insurance can be essential for protecting your family in the event of a tragedy.

It also has tax benefits and other uses.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

The money invested will fetch good returns and will be returned fully as sum assured either after the completion of the term or after the demise of the insured.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

How can life insurance help?

Gerber life whole life insurance provides financial protection for you and for your family when you're no longer here.

Adults aged 18 to 70 may apply for a policy, and applying is easy.

Here are the top five benefits of whole life insurance for you to consider

Life insurance cover4 for financial security of your family.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their monthly bills.

Here, the policy may be utilized as a business continuation plan.

Term life insurance is a top choice for people who want to cover financial obligations that are common when raising a family.

The main types of life insurance are term life, whole life and universal life.

With so many life insurance options, you can.

The endowment life insurance plan has all benefits of a term insurance plan.

As per this insurance plan, the accumulated funds through the premiums are collected as the insured's asset, the benefit of which is distributed regularly to the insured, after he takes a professional retirement.

That is, if the policyholder dies during the policy tenure, then the insurance amount is given as a lump sum to the nominee.

A term insurance plan does not provide maturity benefits like.

Hdfc life insurance company limited.

Risk life insurance implies insurance protection1 against unfavourable developments for the life and health of an insured person.

Risk insurance also exists in the form of credit life insurance where the lender acts as the beneficiary2.

This type of insurance relieves the insured person's relatives of the.

If you die while your policy is in force, your policy pays a death your life insurance policy often provides more than just death benefits, though.

For example, you'll also find options for living benefits that can help pay.

Permanent life insurance such as whole life accumulates cash value at a guaranteed rate as long as the policy is in effect.

Buying it as a gift for a child can be an affordable way to meet many.

What is an executive bonus plan, also known as an irs section 162 plan?

A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance.

To get tax deduction under section 80c, the premium of a life insurance.

Life insurance payouts are usually fast.

In most cases, your beneficiaries will receive a cash payout very quickly after your death.

We often think of life insurance as providing benefits to our loved ones after we pass away.

Unlike term life insurance, permanent life insurance isn't just a death benefit.

It's also a sort of savings or investing vehicle.

One potential benefit of universal life is that the premium is somewhat flexible.

Sometimes life insurance benefits are left unclaimed after a policyholder dies.

This is an unfortunate problem under any circumstances, but especially now, when many people are struggling financially.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

When candidates are searching for a new job, benefits are a main differentiator, and prospective employees tend to consider a position's benefits before they apply.

By chris huntley on march 24, 2021.

Being wealthy provides many financial advantages that only the establishing an irrevocable life insurance trust or ilit is another advantage that can be used by the wealthy.

For those unfamiliar with how an ilit.

To avail of this benefit, it is imperative to get admitted at any of the.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

A variety of life insurance options are available.

In the event of a terminal illness diagnosis with a life expectancy of 12 months or less, this benefit provides for an early payment of up to 100 percent of the life insurance amount.

Group life insurance coverage is usually based on your salary, and depending on how much financial support your family needs, you may need more coverage almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard. 5 Benefits Of Life Insurance. Purchasing life insurance while you're.Ternyata Asal Mula Soto Bukan Menggunakan DagingBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi Luwak9 Jenis-Jenis Kurma TerfavoritCegah Alot, Ini Cara Benar Olah Cumi-CumiKhao Neeo, Ketan Mangga Ala ThailandResep Garlic Bread Ala CeritaKuliner Resep Ayam Suwir Pedas Ala CeritaKulinerSejarah Gudeg JogyakartaResep Racik Bumbu Marinasi IkanResep Stawberry Cheese Thumbprint Cookies

Comments

Post a Comment