5 Pros Of Life Insurance Term Life Insurance Premiums Rise Every Five Years.

5 Pros Of Life Insurance. Term Life Insurance Premiums Rise Every Five Years.

SELAMAT MEMBACA!

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

It's possible to own more.

If you've been around the life insurance industry for more than five minutes, it's pretty likely that you've encountered all sorts of reasons as to why whole life insurance is bad.

Being a hater of whole life insurance seems to automatically identify someone as being part of some club.

Benzinga can help you pick the best life insurance for you in 2021.

Are you considering fabric for your life insurance needs?

Check out the pros, cons and sample premiums that fabric offers for term life insurance.

But would you want to leave your family and loved ones with your financial burdens?.

Pros of indexed univeral life dealing with growth and taxes.

Learn how indexed universal life's growth works.

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Iul), that only exaggerate the bad and the cons of indexed universal life insurance to suit.

What better way to provide you with financial peace of mind when the market is crashing than an iul policy?

The current stock market melt down is a great example of why indexed universal life insurance is such a fantastic tool for building and maintaining wealth, all wrapped up in a tax favored vehicle.

Buy from a reputable life insurance company your life insurance policy is meant to financially protect the people you love when you are no longer.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

5 best life insurance companies.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

Pros & cons of life insurance.

When you shop for life insurance, you're asked to choose between a term and a permanent policy.

Having life insurance is a necessary part of your overall financial plan.

Make a difference today for a secure tomorrow.

5star life insurance company is committed to providing the highest level of service.

Though term life insurance is simpler than whole life insurance, it still comes with many variations.

The main types of term life insurance include with this type of life insurance, the premium is guaranteed to remain level for the entire insurance term.

So if you start off paying $20 a month, you'll.

Ladder controls the underwriting and risk analysis, which means they are able to return.

Bestow life insurance offers term life insurance from 10 to 30 years in coverage, with death benefits from $50,000 to $1.5 million and rates starting at $10 per month.

U.s citizens between the ages of 18 and 60 are encouraged to apply, but only those in good or better health will be approved.

Read our top 5 tips.

The pros of term life insurance are the affordable premiums, optional riders that can broaden the coverage, and the ability to convert the policy to pro:

Each policy contains a cash value account and the cash can be accessed by the policy owner for any reason.

Term life insurance provides coverage for a set period of time, usually around 20 to 30 years.

The goal is to protect your beneficiaries financially should you die during your working years.

Term life insurance policies are also much more affordable than whole, as the policy doesn't have a cash value until you.

The insurance company's ease of use through its online portal enables the cost of life insurance depends on a number of factors like age, general health, medical conditions and the type of policy selected.

Life insurance can offer protection and flexibility to your financial strategy.

Allianz offers term insurance and fixed index universal life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

This fintech issues term life insurance in minutes for those aged 21 to 54.

Learn about its pros, cons and costs now.

You'll have your pick of coverage amounts ranging from $50,000 to $1.5 million and lasting 10, 15, 20, 25 or 30 years.

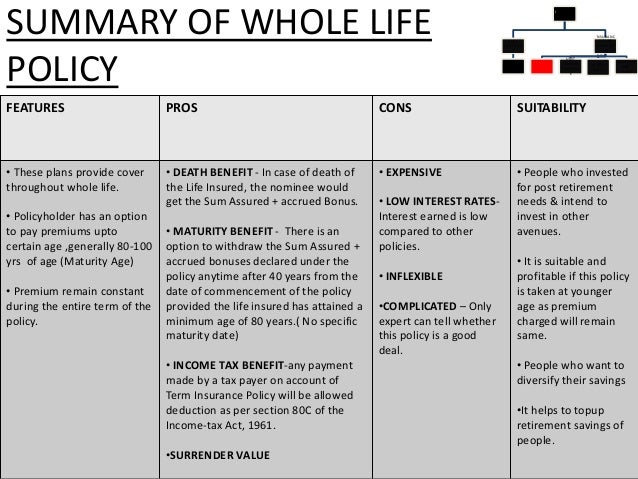

Modified whole life insurance entails a lowered amount of premium due in the earlier years of one's contract.

In traditional insurance plans, the premium amount remains flat from start to conclusion.

Anyone age 50 or older can join.

Term life insurance premiums rise every five years.

Fewer than the expected number of complaints to state regulators.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period the cons of whole life it has a higher monthly outlay and difficult to qualify.

The pros of whole life.

Pros and cons of permanent.

Other types of life insurance policies.

You want to layer your life insurance coverage throughout your life in order to match with your existing financial needs at the various stages of your life.

Your mortgage company or lender receives the payout also called mortgage death insurance, this type of insurance works in a similar way to decreasing term life insurance.

The coverage amount and length.

Pros and cons of life insurance held inside hostplus super.

Learn about the pros & cons of life insurance inside your smsf.

While premiums may be tax deductible to the fund, benefit payouts.

Awas, Bibit Kanker Ada Di Mobil!!Ternyata Cewek Curhat Artinya SayangFakta Salah Kafein KopiCara Benar Memasak SayuranTernyata Mudah Kaget Tanda Gangguan MentalJangan Buang Silica Gel!Ternyata Tidur Bisa Buat MeninggalIni Cara Benar Cegah Hipersomnia10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)6 Khasiat Cengkih, Yang Terakhir Bikin HebohLearn about the pros & cons of life insurance inside your smsf. 5 Pros Of Life Insurance. While premiums may be tax deductible to the fund, benefit payouts.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

To protect yourself and your family, there are many types of insurance packages that certainly offers safety when an unexpected there are many advantages and disadvantages of life insurance policies that are described below.

Life insurance gives you the peace of mind you need.

It is not unusual for people to think that their life insurance premiums are a waste of money list of the disadvantages of life insurance.

A term life insurance policy is usually fairly easy to.

Life insurance have both advantages and disadvantages.

Buying the life insurance is one of the best decisions that everyone should make in their life.

Indexed universal life insurance (and universal life insurance, for that matter) has a lot of fees.

Just look at the above.

We have addressed those disappointments by describing the disadvantages of indexed universal life insurance.

Life insurance comes in many shapes and sizes and each has different advantages and disadvantages.

But there are two primary types of the cost of life insurance is based primarily on your age (when you buy the policy) and your health.

Certain term life insurance policies allow you to.

/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg)

As amazing as life insurance sounds, it does have its downsides.

You should be healthy for affordable life insurance companies create premiums based on the risk of a payout.

Someone with a chronic disease or that skydives for a living, for example.

These benefits are offset by the disadvantages.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Although there are many benefits of life insurance, life insurance companies have lots of experience in minimizing their own risks, and life insurance.

When there are less risks for the provider.

The disadvantage of life insurance is that for the vast majority the insureds do not match their survivor's need for cash upon their death with the 'right kind' of insurance plan.

A married insured whose spouse relies upon their income to sustain the expenses of daily living.

If we talk about the disadvantages of insurance, there are no such disadvantages.

But there are a few disadvantages as mentioned below

According to wikipedia, life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium.

The disadvantages of buying life insurance may be less obvious, but they still exist.

Here are some of the most common disadvantages

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

Ul (universal life insurance) policy is a kind of life insurance product with a life equal to yours.

If you live for 95 years, it will last up to 95 years, and it will here are the top 7 disadvantages of universal life insurance:

Life insurance is a process of putting in place a sort of shock absorber for your dependents in case of your sudden death.

In the process, you also get some benefits from insuring your life.

As opposed to any other type of financial investment, you can get favorable treatment as it relates to tax.

The main disadvantage associated with term insurance is that your premiums increase every time coverage is renewed, because of the chance of.

Life insurance is most common and popular financial products carried out by the people.

There are many types of life insurances like term life insurance in us, life insurance is basically taken to be an investment item for consumption.

While life insurance is great in a lot of ways, it's not immune to some drawbacks.

The biggest one we can identify is the fact that you can't just buy it because you want to.

The life insurance company has to approve your application for life insurance.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Learn more in our guide.

Sun life go term life insurance is a standard term life insurance option that guarantees your premiums in the first 10 or 20 years of your policy.

A health insurance policy is usually valid for a period of one year.

You need to take active measures in order to keep the policy active.

If you fail to renew the policy in time, you may face a lot of issues including financial losses.

Death benefits may be exempt from estate taxes if the policy is properly owned.

Cash values increase deferred taxes over the life of the insured.

Life insurance plan is unique investments that will greatly help you to meet your needs saves the important goals in your life and protect your assets.

Usually, life insurance is a policy that is bought by individuals against possible unforeseen events.

Although the idea of insurance in general is accepted as a prudent undertaking, many people also view it warily.

They see disadvantages, not in the idea, but in how insurance companies use rules and.

Unfortunately, if you access your cash for any reason early on in the policies life, you'll be diminishing the stablility of the policy unless you pay it back with any loan interest required in a timely manner.

Universal life insurance cash value will decline in the long run, but this is supposed to happen. 5 Pros Of Life Insurance. Unfortunately, if you access your cash for any reason early on in the policies life, you'll be diminishing the stablility of the policy unless you pay it back with any loan interest required in a timely manner.Kuliner Jangkrik Viral Di JepangFoto Di Rumah Makan PadangResep Selai Nanas Homemade3 Cara Pengawetan Cabai5 Cara Tepat Simpan TelurIni Beda Asinan Betawi & Asinan BogorTernyata Bayam Adalah Sahabat Wanita7 Makanan Pembangkit LibidoStop Merendam Teh Celup Terlalu Lama!Khao Neeo, Ketan Mangga Ala Thailand

Comments

Post a Comment